In its interest rate forecast, UBS expects the Swiss National Bank to raise the key interest rate again by 0.25 percent in view of inflation remaining above 2 per cent. It writes: ”

In mid-June, the U.S. Federal Reserve and the European Central Bank will discuss whether to continue raising interest rates. One week later – on 22 June – the governing board of the Swiss National Bank (SNB) meets to determine the Swiss key interest rate.

While headline inflation in Switzerland has fallen significantly, core inflation (excluding energy prices) remains stubbornly above the 2% mark. This will likely prompt the SNB to raise interest rates again by 0.25 percentage points to 1.75 percent, which we expect to be their peak rate. In the second half of the year, we expect SNB key interest rates to be stable, with a first interest rate cut in mid-2024.”

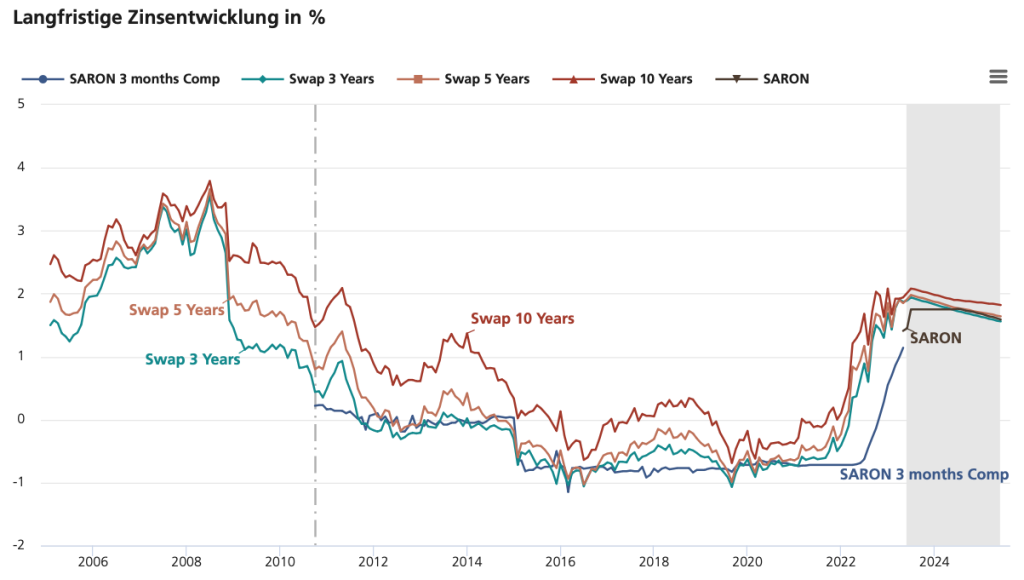

However, the bank predicts that these interest rate hikes are already expected by the markets and should therefore have little impact on the yields of government bonds and mortgage rates. UBS continues: “In the longer term, we expect interest rates to fall slightly, if the focus of the markets shifts to the first key interest rate cuts.” Accordingly, the forecast chart already shows a stable to slightly declining trend in Saron interest rates from the second half of the year.

Sources: Bloomberg, UBS Switzerland AG; Rates through the end of 2010 are based on Libor, and on SARON from 2011. The effective interest rate of the product is calculated using the margin + compounded SARON of the accounting period. When calculating the interest rate, the compounded SARON can never be less than zero.

avobis also comes to similar conclusions in its current assessment of the interest rate market. It writes: “The current adjustment of the mortgage reference rate in Switzerland raises the question of a potential inflationary spiral and underlines the expectation of a further rate hike of at least 25 bps in the upcoming June meeting. Meanwhile, the international monetary policy context points to significant changes: The ECB is nearing the end of its rate hike phase and the Fed, after a series of continuous rate hikes, now seems to be moving into pause mode.” And further: “Last week’s adjustment of the mortgage reference rate now allows for an increase in existing rents of up to 3.0%. This is a positive development for real estate landlords, but at the same time triggers monetary policy concerns about possible inflationary jumps. The SNB recently repeatedly underlined its determination to counteract this by raising interest rates further, making another rate hike this month a certainty.” According to avobis, a 50-point hike at the SNB’s June meeting is the most likely scenario.