For owners of private real estate, mortgage interest rates and their future development are among the most important cost factors. After a long phase of unchanging low interest rates – both on the capital market and on the mortgage market – there is currently great uncertainty about their future. The long phase with the pandemic and even more so the war in Ukraine have shaken the goods, stock and capital markets. The media comment almost non-stop on the changes in the markets. We have therefore compiled a few current analyses on the financial markets from Swiss sources for you, in order to show where the mortgage interest journey could actually go.

UBS interest rate forecast – mortgages in the current interest rate environment

For UBS, the central question is how aggressively the central banks react to the respective economic framework conditions in the respective countries. These are clearly different in Switzerland than in the EU or the USA, for example. UBS writes on her website:

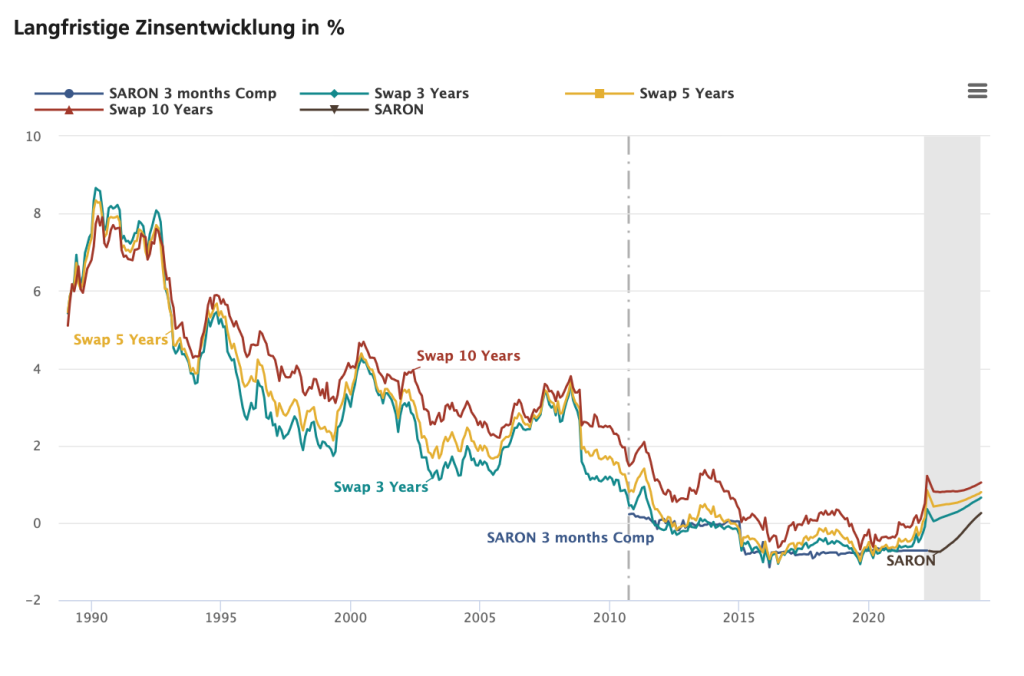

“In the slipstream of US and German interest rates, 10-year interest rates in Switzerland have risen by almost 1 percent since the beginning of the year. High inflation in Europe and the USA, the rise in energy prices in recent months and increasingly nervous central banks have led to this sharp rise in interest rates.

The war in Ukraine and massively higher energy prices not only lead to high inflation in the short term, but also weigh on the economy, reducing longer-term inflationary pressures. This calls into question whether central banks will really react as aggressively as longer-term interest rates reflect today. If this is not the case, the sharp rise is an exaggeration and interest rates on Bunds and mortgages are likely to settle back at lower levels in the coming quarters.”

Sources: Bloomberg, UBS Switzerland AG; Values up to and including 2010 are based on Libor and from 2011 on SARON. The effective interest rate of the product is calculated from Margin + Compounded SARON of the respective settlement period. For the calculation of the interest rate, the Compounded SARON can never be less than zero.

ZKB sees the end of the SNB’s negative interest rate policy approaching

In his article on the development of interest rates in Switzerland, David Marmet, chief economist of the ZKB, sees an end to the SNB’s negative interest rate policy. He wonders whether the war in Ukraine and the associated rising energy prices, the foreseeable end of the pandemic and a renewed increase in global demand will cause inflation to rise in Switzerland as well – and with it mortgage rates. With regard to the development of mortgage interest rates, he draws the following conclusion: “Since the participants in the financial markets expected significantly more than an interest rate increase from the SNB by the end of 2022, the yields of Swiss government bonds have also risen. This in turn led to rising mortgage rates. Will the rise continue unchecked? According to our estimates, the SNB will not raise key interest rates to the extent expected by financial market participants. However, the Swiss will not be able to completely escape the global yield momentum. This argues for slightly higher Swiss yields – and indirectly also for slightly higher mortgage rates. Thus, the turnaround in interest rates has been heralded, but the interest rate level will remain below the historical average for a very long time.”

The VZ VermögensZentrum recommends calmness

In an article by Adrian Wenger, mortgage expert at VZ Vermögenszentrum, the author advises that it is now important to remain calm despite rising mortgage rates. It is true that the fact that interest rates for long-term fixed-rate mortgages have risen by up to one percentage point in recent months is alarming. He writes: “Fearing that they could rise further, many mortgage borrowers want to lock in the low interest rates as quickly as possible. From a sober point of view, this does not make sense. It is still worth choosing a short-term mortgage. Money market mortgages (Saron) are still much cheaper and more flexible.”

There are a number of reasons against switching immediately, he says, listing:

- While interest rates for fixed-rate mortgages are based on the capital market, those for money market mortgages in Switzerland depend on the interest rate policy of the Swiss National Bank (SNB).

- The saron is currently around minus 0.75 per cent. But banks calculate with an imputed lower limit of at least zero per cent. So anyone taking out or renewing a mortgage benefits from an interest rate buffer of 0.75 per cent.

- This means that a money market mortgage will only become more expensive if the SNB raises its key interest rate above zero percent. This would require, for example, four interest rate steps of 0.25 percentage points each.

- And before the money market mortgage would become as expensive as the fixed-rate mortgage, the key interest rate would have to rise by 2 percentage points or more. So far there are no signs of that. And experience shows that interest rate increases are usually slower than interest rate cuts.”

He only recommends switching when there is a clear change in the trend: “If you pay 0.85 per cent for your money market mortgage today, you will still pay 0.85 per cent even if the SNB raises interest rates by 0.75 percentage points to zero per cent. Only when the key interest rates, and thus the Saron, rise above this threshold does the mortgage rate also rise. If the key interest rates rise by a whole percentage point to plus 0.25 percent, the money market mortgage will now cost 1.1 percent (0.85 plus 0.25 percent). Even then, however, it is still much cheaper than a fixed-rate mortgage. Money market mortgages have practically always been cheaper than fixed-rate mortgages over the past 30 years.”