Prices for private residential property have risen sharply again this year, according to the latest analysis by IAZI. With these rising prices, anyone who manages to buy one of the scarce owner-occupied homes can call themselves lucky, it continues. Because homeowners could save hundreds of francs a month compared to renting. But the hurdles to entering the owner-occupier paradise are still very high. With current prices and affordability rules, the dream of owning a home is increasingly becoming an unfulfilled dream for the majority of Swiss residents.

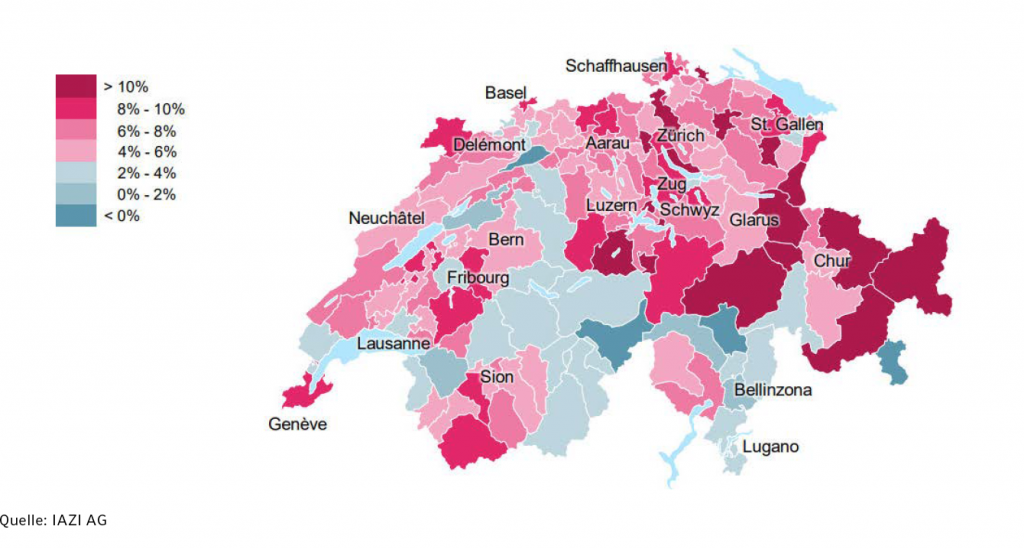

Cumulative price development for residential property since Corona erupted; source: IAZI

Home price growth over 5 per cent in one year

IAZI writes: “Prices for private residential property have risen strongly since Corona erupted in 2020. Single-family homes reached 5.8% price growth last year alone . This is the highest annual growth since the beginning of 2013. Condominiums reached a price growth of 5.1 % in this period . This is the highest annual growth since the beginning of 2014. Especially in peripheral regions such as Graubünden, the Jura or Central Switzerland, price growth was very high.”

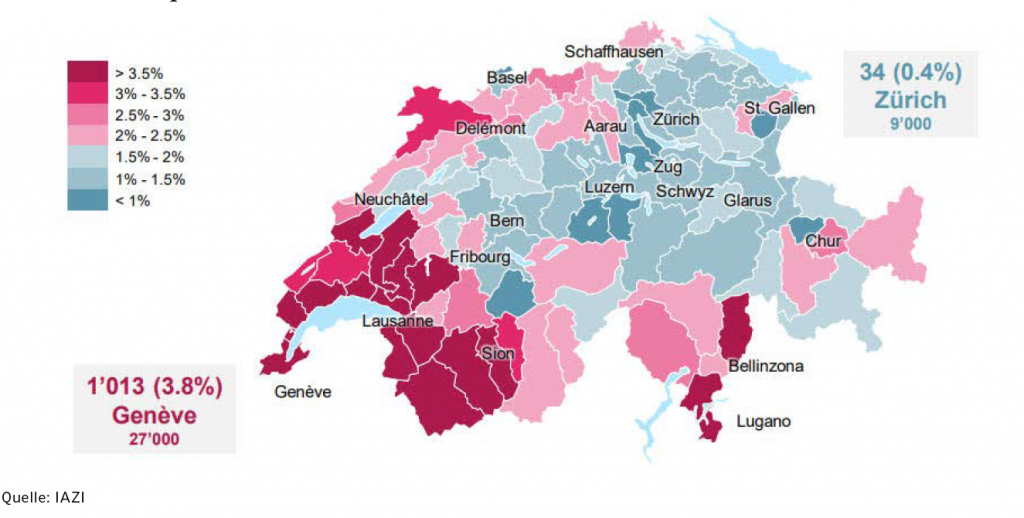

Market liquidity of single-family houses in the 1st semester 2021; Source: IAZI

There are many reasons for this, says IAZI. On the one hand, the desire for one’s own home in the countryside has risen again, on the other hand, the willingness of older homeowners to part with their own home has become smaller, and thirdly, the construction of single-family homes in Switzerland has been steadily declining for years. While around 18,000 new single-family homes were built in 1990, in 2019 the figure was just under 6,000. The tendency to replace single-family homes on larger plots with apartment buildings due to high land prices is also contributing to the declining supply.

According to IAZI, the situation for condominiums is somewhat more relaxed. In the MS region of Zurich (city of Zurich), 484 properties were on offer in the first half of 2021. In the MS region of Geneva, there were 1423 properties.

Eternal boom or price crash?

Prof. Dr. Donato Scognamiglio, CEO of IAZI AG, did not want to give a forecast on the further development of prices at the media conference. Nevertheless: the era of money flooding should slowly come to an end – the larger central banks are likely to gradually increase their key interest rates slightly next year. The current – in some countries quite high – inflation rates are triggered by rising prices and by rising wages and the related increase of demand. Part of the inflation is certainly triggered by the current supply problems for e.g. construction raw materials, computer chips and energy (gas, oil, electricity).

Despite concerns about excessive inflation, however, central banks are holding back on raising interest rates for fear of stifling the economic upswing. The Swiss National Bank (SNB) does not want to raise interest rates despite the current slight inflationary tendencies (but within the target range of 2 per cent) and also wants to continue its expansionary monetary policy.

Demand on the real estate market is therefore likely to continue to be driven by record low mortgage rates, the desire to own a home in the countryside and the significant savings compared to renting. Only significant interest rate hikes could change this – the SNB speaks of a possible “unexpected interest rate shock”. There are no signs of a strong increase in the supply of residential property to satisfy the excess demand in the coming months. So the tipping point is and will remain the development of interest rates in the coming months.