In its latest assessment of the situation, the property valuation company IAZI writes that the “new normality” in the Corona regime has not yet caused any major price corrections in the Swiss property market. However, the properties in the gastronomy, hotel and tourism sectors are facing very great challenges. At the same time, it was already foreseeable that the corona pandemic would lead to a shift in preferences with regard to the choice of location.

The corona pandemic, which has been raging since the beginning of the year, has massively changed the lives of all inhabitants, IAZI continues. All economic research institutes were expecting a sharp drop in GDP in 2020 and a strong upswing next year.

Private homes remain in demand

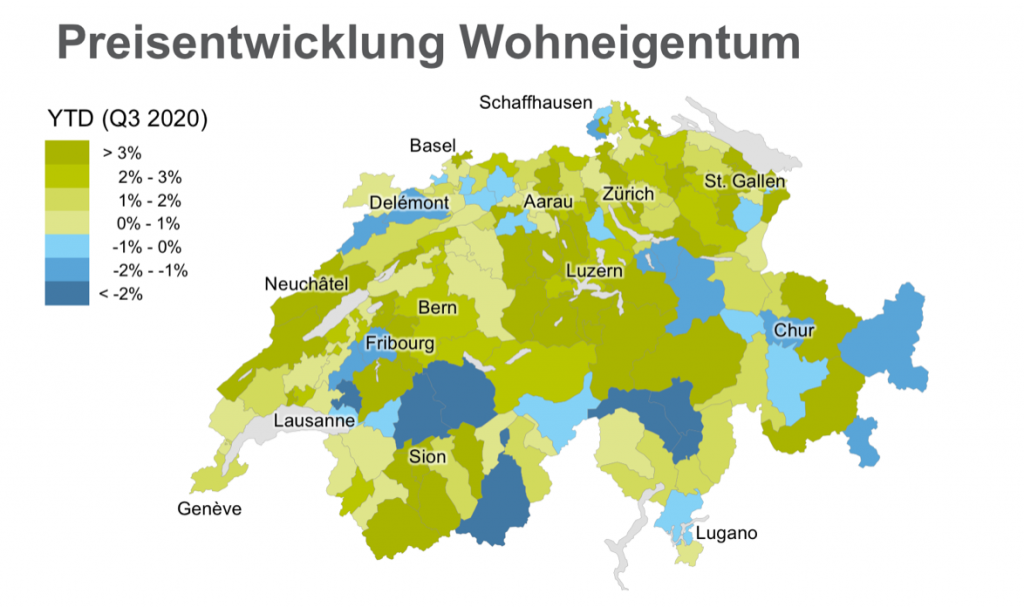

Residential property price trends; Source: IAZI

According to the IAZI price indices, private residential property (single-family houses and condominiums) still shows strong price growth over a one-year period (+2.4 % for single-family houses; +3.2 % for condominiums). One reason for this is the still historically low mortgage interest rate levels. This gives those who have the necessary own funds the opportunity to realise their dream of owning their own four walls at favourable conditions.

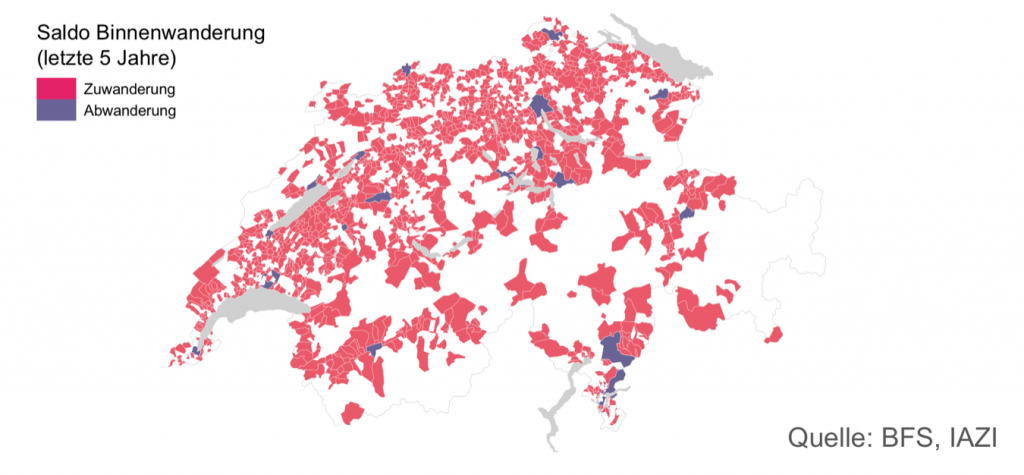

Migration to the countryside; Source: BFS, IAZI

However, prices for private residential property are still at a very high level, which, according to IAZI’s analysis, has led to migration from the big cities to the surrounding regions.

Prices for apartment buildings still robust in uncertain times

According to the IAZI, year-to-date prices for multi-family houses moved sideways in November this year with a slight decline in price growth of -0.8 %. This indicates that the stricter rules for financing multi-family houses that have been in force since the beginning of the year are having the desired effect. Behind the extreme cases of purchasing properties at extremely low returns are mostly players who are not dependent on external financing by banks.

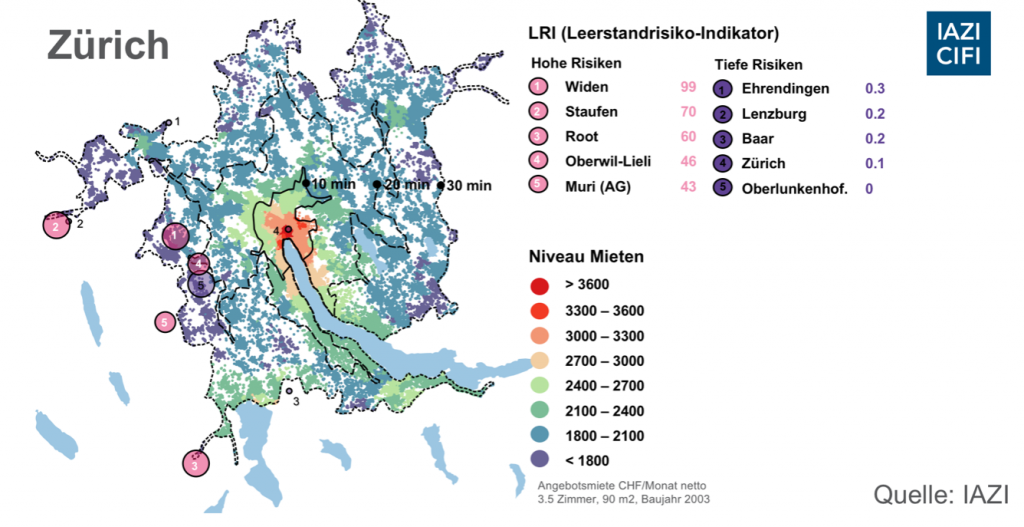

Vacancy risk indicator; Source. IAZI

Among other things, IAZI has also investigated how vacancy risks and rent levels have developed at the community level in the areas surrounding the 5 largest major centres in Switzerland, such as Zurich and its environs. Swiss rents (i.e. advertised rents) are currently stable to slightly declining, except in Zurich. This stability is due to the fact that the positive migration balance (immigration minus emigration) in the municipalities has generally not changed much compared to the previous year.

Value adjustments expected for commercial real estate

Caused by the nationwide lockdown phase in March and also by local lockdowns, the property value of commercial properties will decrease. In particular, businesses in the catering, hotel and tourism sectors are very much referred to by Corona, and in this environment business closures are to be expected. In the case of retail space, the structural change will continue due to the migration to online trading. In the case of office space, we believe that the home office mode will in all likelihood become partially permanent, which in the longer term could mean that less office space will be in demand on the market. However, the space required for an office workplace will become larger in order to maintain the necessary distances.

How Corona changes the location of residential properties

In two fact-based analyses, IAZI has investigated how the corona pandemic has changed the behaviour of each individual and the demands on housing. These corona-induced behavioural changes have also changed housing needs. Quality of housing, individual means of transport, proximity to green spaces and, in particular, the size of the dwelling are at the centre of these changes. The additional need for office space in the home should reinforce this trend in the future.

Top-Standort für das «new normal»

IAZI has reassessed the attractiveness of the location at the municipal level throughout Switzerland due to shifts in preferences. The calculation is based on 40 individual indicators, whereby only municipalities with 2000 inhabitants or more are taken into account. These indicators relate to values concerning the labour market, housing situation, travel times, school, medical and cultural care, etc., although here, changed priorities are already apparent. For example, the number of doctors or hospitals in the municipality now has greater weight. The top locations identified for living in the “new normality” are 1. Männedorf (ZH). 2. Erlenbach (ZH), 3. Hergiswil (NW), 4. Beckenried (NW), 5. Stans (NW), 6. Uitikon (ZH), 7. Ennetbaden (AG), 8. Ennetbürgen (NW), 9. Kilchberg (ZH) and 10. Zug (ZG).