As recently as last autumn, most financial institutions were still predicting low interest rates and only moderate inflation for Switzerland. The Swiss National Bank’s expansive monetary policy has successfully ensured a low Swiss franc exchange rate, attractive interest rates, continuous growth and barely perceptible inflation for years. The exporting economy and investors in yielding properties have benefited from this development, including to a large extent the institutions that have to pay for the pensions of the older generations. However, the low interest rates and the difficulty of finding profitable investment opportunities have also led to investment properties being built and bought in locations that were never really profitable.

The year to date has been characterised above all by shortages, said Prof. Dr. Donato Scognamiglio, CEO of IAZi AG, at his media orientation. There is a lack of solutions to the armed conflict in Eastern Europe, a lack of goods due to weakened supply chains, a lack of energy for the coming winter, and finally a lack of options for the central banks as to whether interest rates need to be raised further to combat inflation. All this leads to a situation that is fraught with considerable risks, not only in the economy but also at the political level.

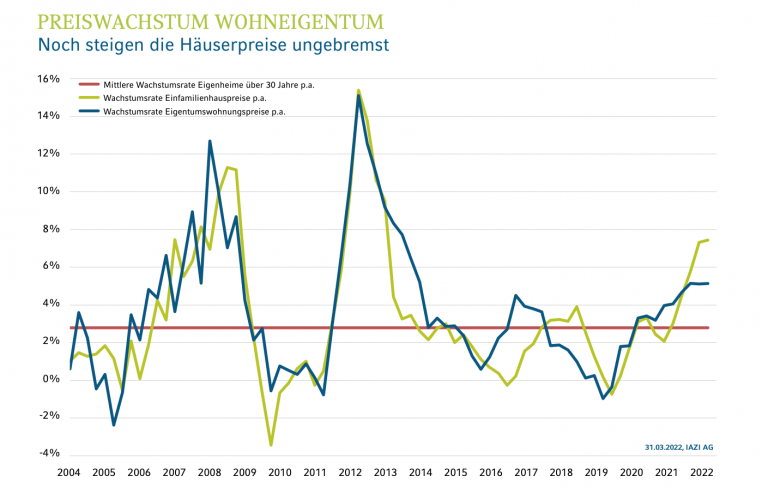

Investors in yielding properties in particular are now facing a cooler wind, Scognamiglio contends, and continues: “Various factors indicate that they will have to thoroughly rethink their investment strategy in the context of the interest rate turnaround. The times of the investment emergency are definitely over. The previously positive difference between the net return on investment properties and 10-year Bunds has narrowed dramatically as a result of the interest rate turnaround. Until the turnaround in interest rates, one hardly made any money with 10-year federal bonds. Direct real estate investments, on the other hand, achieved impressive net returns of over 3% during this period. Today, the situation is quite different: 10-year federal bonds can earn more than 1% p.a., while the net returns on real estate have hardly risen so far.”

Unfavourable market scenario

Investment properties are becoming less attractive, which is reflected in the further price development, writes IAZI AG and can already see a price correction based on the evaluation of current transactions. In the medium term, however, rising interest rates will lead to an increase in the reference interest rate, which, in combination with current inflation, will allow rents to be adjusted. Strong immigration, the decline in construction activity and low vacancy rates will also have a supporting effect. These effects will counteract the price correction currently being observed. If prices for investment properties were to slide too much, however, it cannot be ruled out that this could develop into an unfavourable scenario for the market.

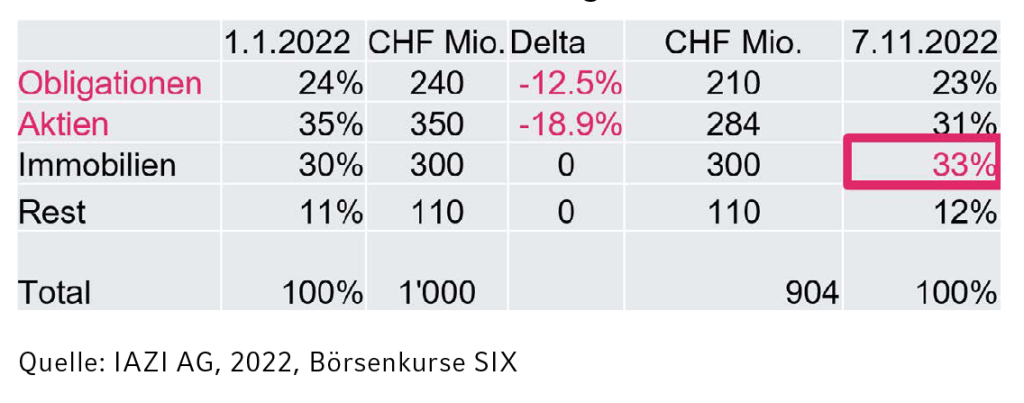

And this scenario is provoked by a more technical risk factor. Swiss pension funds are known to invest considerable amounts in real estate. The Verordnung über die berufliche Alters-, Hinterlassenen- und Invalidenvorsorge (BVV 2) (Ordinance on Occupational Retirement, Survivors’ and Disability Pension Plans), which is relevant for these players, prescribes a fixed quota for real estate investments that may not exceed 30 %. Because equities and bonds have fallen sharply in value since 1 January 2022 – Swiss equities minus 18.9 %, bonds minus 12.5 % – the real estate quota in some portfolios will increase above the limit, as the following calculation example shows (see chart no. 1). According to a recent study by a bank, around 25 % of the pension funds examined exceed the required ratio of 30 %. This could lead to increased sales on the market for investment properties in order to meet the quota requirements.

Grafik 1: Falling share and bond prices cause real estate ratio to rise

The green idyll continues to be in demand

The picture is somewhat friendlier for private residential property. Here the Corona pandemic has triggered a real boom phase, especially for single-family homes.

However, the analysed transactions of owner-occupied homes indicate that especially for condominiums a slight price correction is to be expected from the 4th quarter of this year, while the prices for single-family homes will remain at the same level, i.e. here the price development will run sideways.

Overall, the interest rate turnaround has made the situation more difficult for those willing to buy. At over 3 %, 10-year fixed-rate mortgages in particular cost considerably more today than at the beginning of the year. There is a temptation to switch to the still relatively cheap Saron mortgages. But it is currently impossible to predict how high the Saron will rise if the Swiss National Bank decides to raise interest rates further in order to get inflation under control.

Only a handful of flats in Zurich

In the rental flat segment, strong demand has led to a decline in vacancies this year. The vacancy rate fell to 1.3 % in 2022. Regional differences are large. While in the Jura and Ticino up to 3 % of flats are still vacant, in the city of Zurich sometimes up to 500 applicants have to try their luck when viewing a flat. Yet the city of Zurich offers fewer than 200 vacant flats. However, this striking housing shortage is put into perspective by the fact that the tenant population fluctuates greatly. At 14 %, the fluctuation rate is highest for private rental flats, while it is only half that for cooperative flats.

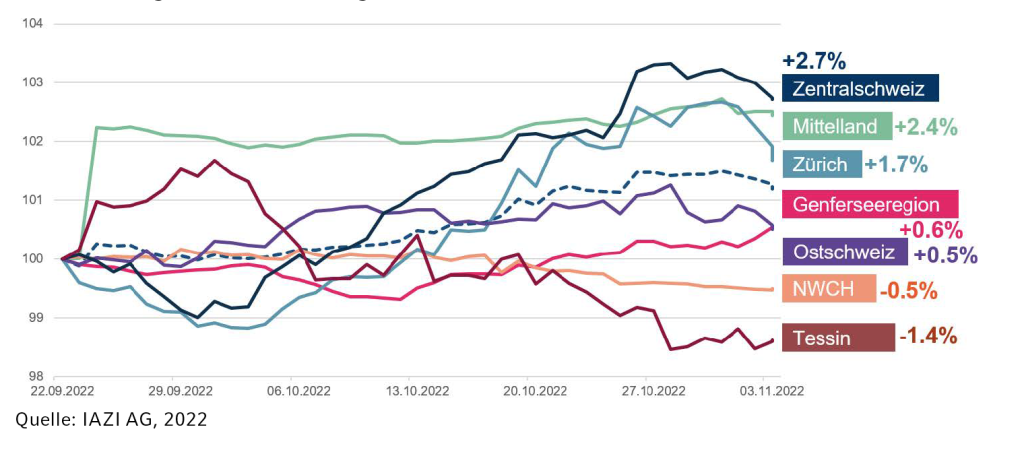

The interest rate turnaround will also confront flat seekers with higher housing costs (see chart no. 2: Supply rents rise). On the one hand, this can be explained by the strong demand for rental housing from the local population and, on the other hand, also from immigrants. At the same time, new construction is limited by the lack of land reserves and by the fact that institutional investors will not increase their real estate quota much in the near future. Most tenants in existing tenancies whose owners have not passed on all reductions in the reference interest rate in the past are still protected from the rise in interest rates.

Chart 2: Asking rents rise in the majority of cases

Renting more attractive than buying

The sharp rise in mortgage interest rates has caused the cost for homeowners to rise sharply if they want to renew their mortgage again with a fixed-rate mortgage. The years when it was much cheaper to own a home due to low interest rates seem to be a thing of the past. Many homeowners, however, will only feel this increase in costs when their mortgage expires or is renewed. Those who have used the time in the past to pay off their mortgage and have built up reserves can, however, be relatively relaxed about a further rise in interest rates.

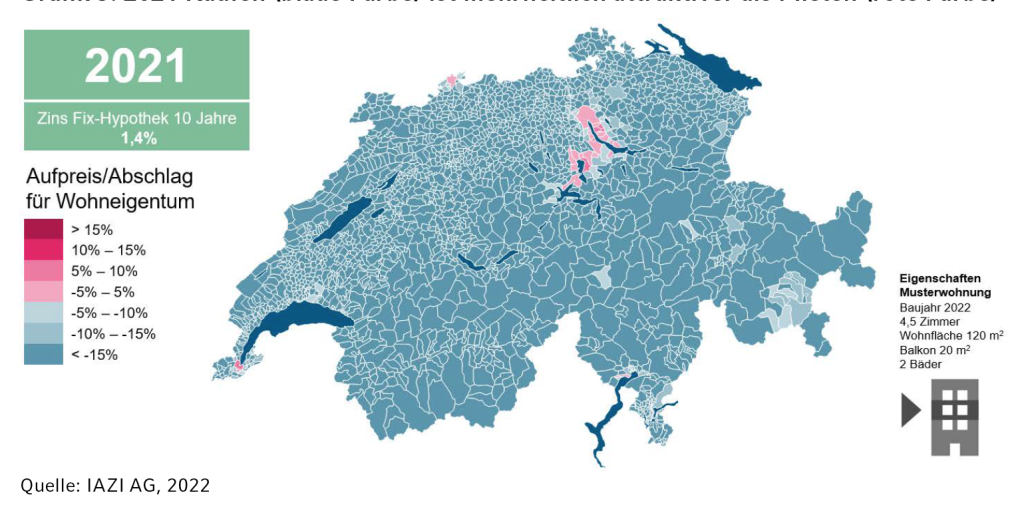

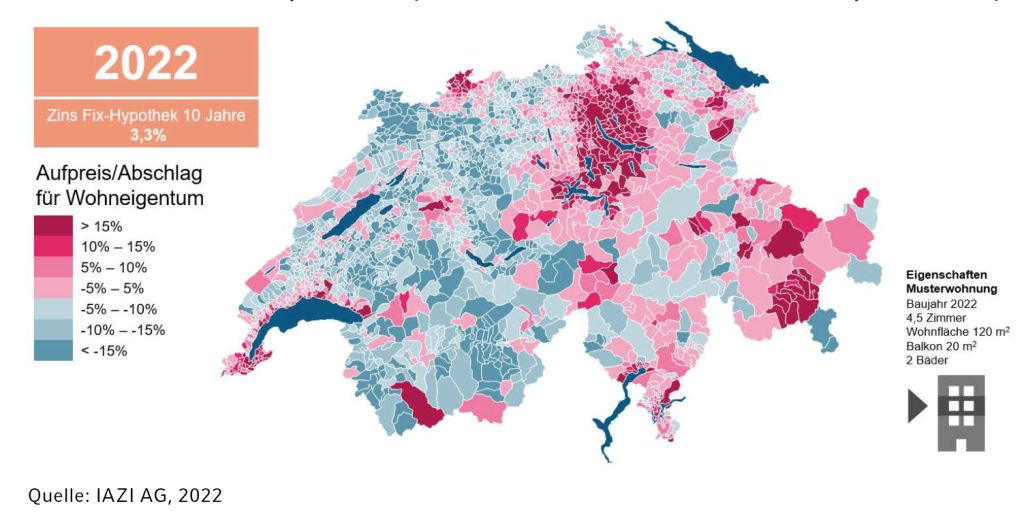

The turnaround in interest rates has meant that in most Swiss municipalities it is currently cheaper to rent a flat than to buy a condominium (cf. charts 3 and 4). However, the renters forego possible increases in value.

Chart 3: 2021 Kaufen (blaue Farbe) ist mehrheitlich attraktiver als Mieten (rote Farbe)

Chart 4: 2022 Renting (red colour) is more attractive than buying (blue colour) by majority