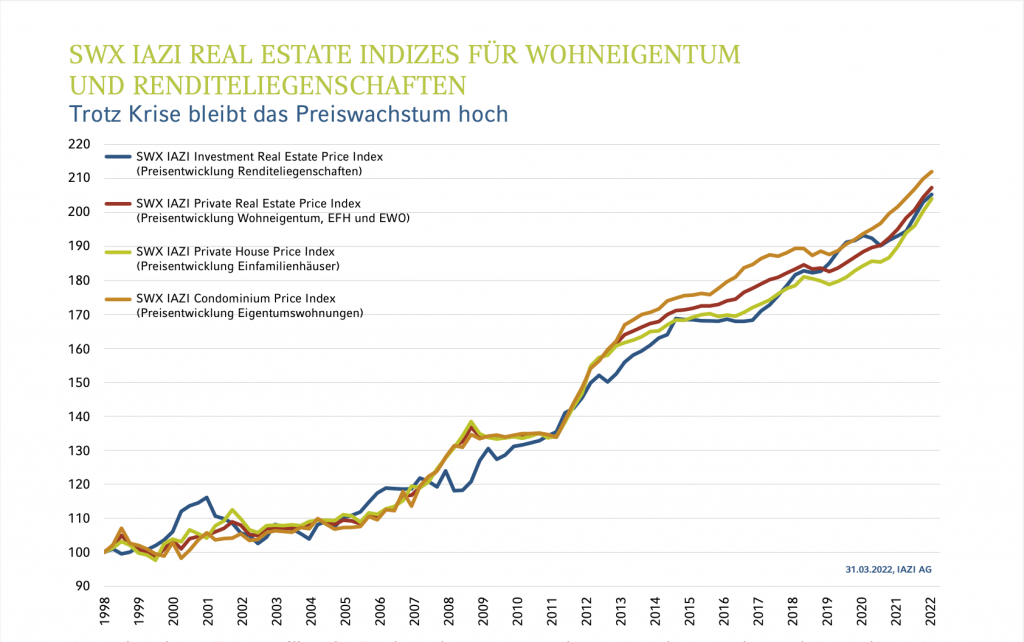

IAZI AG published its report on the first quarter of 2022 under the title “Difficult times ahead for homeowners and savers”. The “SWX IAZI Private Real Estate Price Index” for private residential property (single-family houses and condominiums) continued to show an increase of 1.4% in the first quarter of 2022 (previous quarter: 1.9%). On an annual basis, price growth is still an impressive 6.3% (previous quarter: 6.2%).

Single-family houses even achieved price growth of 1.8% in the first quarter (previous quarter: 2.2%). On an annual basis, the increase amounts to 7.4% (previous quarter: 7.3%). Condominiums recorded price growth of 1.0% in the first quarter (previous quarter: 1.5%). On an annual basis, price growth remains at 5.1%.

“Price growth remains high, although since February other factors have suddenly become decisive for the formulation of economic forecasts,” says Donato Scognamiglio, CEO of IAZI AG. A low supply combined with a high demand for residential property is still considered an important driver for price increases.

An important factor for the price increases is still considered to be a constant supply, combined with a high demand for residential property.

Calculate the purchase of apartment buildings precisely

Prices for multi-family houses also continue to show considerable growth. They achieved price growth of 1.1% in the first quarter (previous quarter: 2.1%). On an annual basis, price growth amounts to 6.3% (previous quarter: 5.9%). “With this sustained price surge, we are now slowly entering a critical phase,” says Donato Scognamiglio. Anyone buying an investment property with a 3 percent yield would have to carefully calculate its financing, as the interest rates for fixed mortgages have risen considerably. These increased financing costs cannot simply be passed on to the tenants, because tenancy law applies here. This means that a rent increase is only possible through an increase in the reference interest rate, which reacts very slowly to changes in the interest rate landscape.

Home ownership costs will rise

The home ownership growth rates achieved during the Corona pandemic may comfort homeowners over the fact that difficult times are now coming their way in the form of higher costs. “Anyone who needs to fill their oil tank today is facing an extraordinary price increase,” says Donato Scognamiglio. In addition, the costs for craftsmen have risen, and the prices for wood and steel have also experienced a price spike. This makes the renovation of properties in particular more expensive.

Inflation has definitely arrived in Switzerland as well

Those who do not own a home, and that is more than 60 percent of the Swiss population, are feeling the consequences of higher inflation in the form of a devaluation of purchasing power. “Inflation has now definitely arrived in Switzerland and has also already shot up above the National Bank’s target range,” says Donato Scognamiglio. With inflation flaring up, he says, savings accounts have become a guaranteed loss-making business. Annual inflation reached a high of 2.4% at the end of March. The savings interest rate is supposed to compensate for this inflation. But if it remains at zero, the real, inflation-adjusted interest rate will be -2.4%. Against this background, the pressure on the SNB to raise the key interest rate is growing.

Solid economic basis in Switzerland gives reason for hope

However, with the many accumulated problems that have been exacerbated by the Ukraine crisis, there are some glimmers of hope. The Swiss economy is in good shape. During the Corona pandemic, it proved very resilient despite uncertainty, lockdowns and supply shortages. “While there are difficult times ahead, at the same time the political and economic players have proven that they can respond to crises quickly, in a solution-oriented and pragmatic manner,” says Donato Scognamiglio.