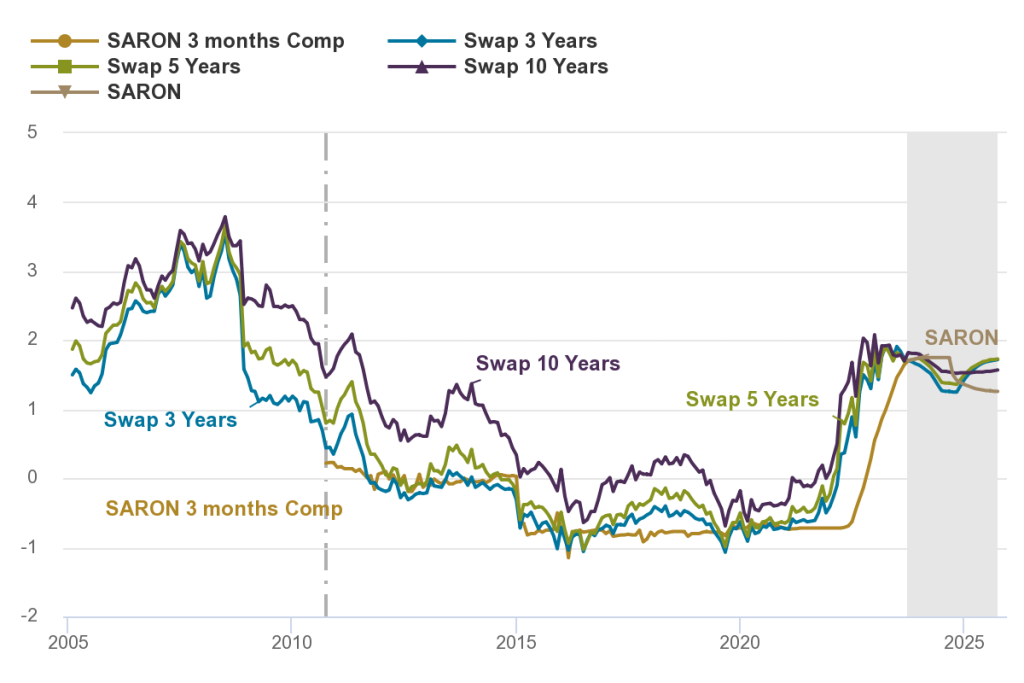

Good news for homeowners with flexible mortgages: In its latest interest rate forecast “Interest rate trends: Surprising SNB decision”, UBS expects stable and later even falling interest rates for Saron mortgages already for the next quarter. It writes: “Mortgage interest rates and government bond yields moved sideways again in September. The surprising decision by the Swiss National Bank (SNB) to keep key interest rates at 1.75 percent in September did nothing to change this.”

As is well known, the Swiss National Bank justified its decision not to raise key interest rates by saying that the economic risks for the further development of the Swiss economy should be weighted higher than the inflation risks. In doing so, it also trusts in the continuing effect of the previous increases in the key interest rates.

Sources: Bloomberg, UBS Switzerland AG; values up to and including 2010 are based on Libor and from 2011 on SARON. The effective interest rate of the product is calculated from margin + Compounded SARON of the respective settlement period. For the calculation of the interest rate, the Compounded SARON can never be less than zero.

According to UBS’s forecast, the SNB’s cycle of interest rate hikes will be completed. The influence on longer-term interest rates would be manageable. Even before the monetary policy assessment, it was clear that the interest rate hikes would soon come to an end and that interest rate cuts would become an issue in 2024.

In conclusion, UBS writes: “The expectation of key interest rate cuts in 2024 should lead to slightly lower interest rates in the coming quarters. The potential for government bond yields is limited, as they are already highly valued. The decline in mortgage interest rates is likely to be more pronounced. Mortgage interest rates linked to the SARON are expected to remain stable.”