At the beginning of the year, the service company avobis conducted a detailed analysis of the credit markets in Switzerland, the EU and the USA. In brief, the company expects interest rates to rise slightly in Switzerland and to stabilise in the longer term.

In avobis’ view, the global economy “is currently in a phase of change, characterised by high uncertainties and volatility”. The impact of the pandemic has led to production bottlenecks and changes in consumer behaviour, which have exacerbated the challenges of persistent inflation and economic instability. Add to this the ongoing conflict between Russia and Ukraine, which is contributing to worsening supply shortages. The divergence of supply and demand has thus led to different inflation scenarios on the international markets. This poses a dilemma for central bank monetary policy, avobis writes: “Either it must tolerate a supply-driven inflation environment or suppress demand through restrictive monetary policy, which could potentially lead to a recession.”

The monetary policy situation in Switzerland

It is obvious that inflation in Switzerland is lower than in comparable regions. However, Switzerland is not used to high inflation, which forced the SNB last year to take the same monetary policy stance as its counterparts in other countries, avobis writes in its analysis. And further, “In fact, the SNB has adopted a more aggressive stance, as evidenced by the ratio of last year’s peak inflation rate to the absolute change in the key interest rate of the same year.” (see figure 1 below)

“In addition to restrictive financial conditions, the SNB’s aggressive stance was necessary to increase the attractiveness of the Swiss franc. By revaluing the domestic currency, the SNB was able to use an important tool in the fight against inflation – especially against imported inflation, which accounts for a large share of inflation.” (see figure 2 below)

“Therefore, from a monetary policy point of view, it made sense to accept an appreciation of one’s own currency in order to fight imported inflation, instead of affecting demand at home and jeopardising economic activity through even more restrictive monetary policy.

Although the appreciation of the Swiss franc is seen as an effective tool to fight inflation, it is only a short-term solution. However, persistent inflation dynamics may lead to a divergence between the expectations of economic agents and those of the SNB, which may affect the credibility of monetary policy. To prevent this, gradual and aggressive adjustments of financing conditions have so far been necessary to bring inflation under control and clearly signal the SNB’s determination in the fight against inflation.

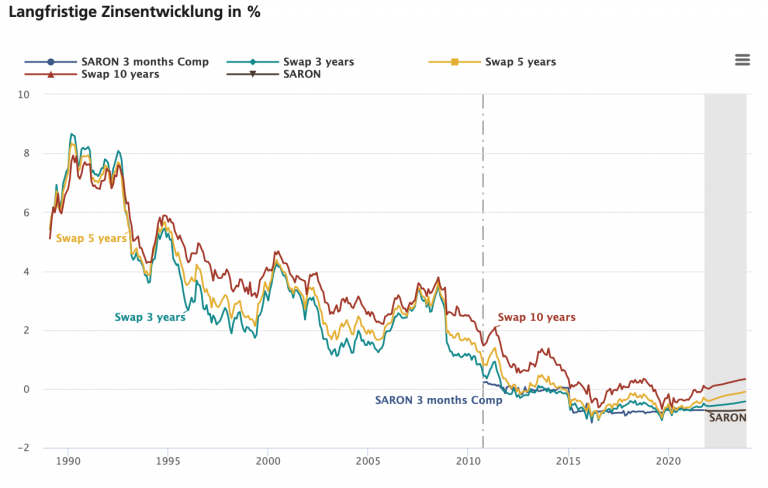

The yield curves (see Figures 3 and 4 below), which have shown a slow flattening in recent months, support the SNB’s credibility and success so far,” avobis writes in its analysis.

“At the short end, interest rates rise both because of increases already made and because of expected future increases, as suggested by the current yield curve in the swap market (Figure 3). At the long end, however, a reduction can be observed due to the reduction of uncertainty, expected inflation and economic growth. This is also confirmed by the reduced implied interest rate volatilities, which indicate an elimination of uncertainty.” (see Figure 5 below)

Conclusion for Switzerland

Based on its analysis, avobis concludes that inflation in Switzerland is likely to decline further in the coming months. Nevertheless, the SNB will probably continue to maintain a restrictive monetary policy and make further corresponding adjustments. avobis expects an interest rate hike of at least 25 basis points in March and an increase in the key interest rate by a total of 50 basis points in the first half of the year.

More details from the Avobis analysis and comparable data for the US and EU markets can be downloaded as a PDF here.