In its online magazine on mortgages, UBS recently documented in detail the advantages and disadvantages of a Saron or fixed-rate mortgage in the current interest rate environment. Based on the current monetary policy of the central banks, the Saron mortgage is likely to become more expensive in the coming months. And this raises the question of whether, over a longer period of time, it could even become the more expensive solution compared to a currently available fixed-rate mortgage. Find out in the article which mortgage model is more favourable in the long term according to the UBS forecast and which factors should also be considered in addition to the costs when choosing a mortgage.

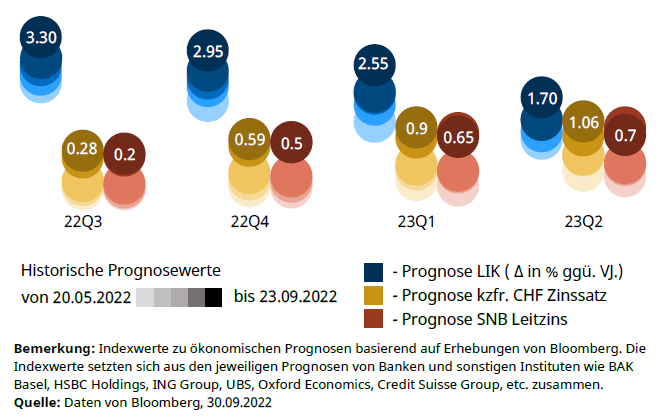

The bank assumes that sarons – including money market mortgages – will continue to become more expensive and writes: “As a result of the latest SNB interest rate move, money market mortgages have become more expensive. A large part of them are currently likely to cost between 2.2 and 2.6 percent. In view of the expected key interest rate hike in June 2023, we expect a further increase in the price of money market mortgages towards 2.5 to 2.9 per cent from that time onwards.”

For fixed-rate mortgages, UBS forecasts a stable to slightly more expensive level: “The SNB’s future interest rate steps are already factored into long-term mortgage rates. We estimate that ten-year fixed-rate mortgages currently cost between 2.7 and 3.2 percent. They are likely to increase in price by a few basis points in the coming months, subject to certain fluctuations.”

Based on these analyses, UBS draws the following conclusion: “Studies over a long time horizon show that money market mortgages were cheaper than fixed mortgages in the past. The advantage was 15 to 20 percent of the cumulative interest payments.

With the further tightening of monetary policy, money market mortgages are becoming more expensive. Mortgages are thus likely to be offered at similarly high interest rates across all maturities.”

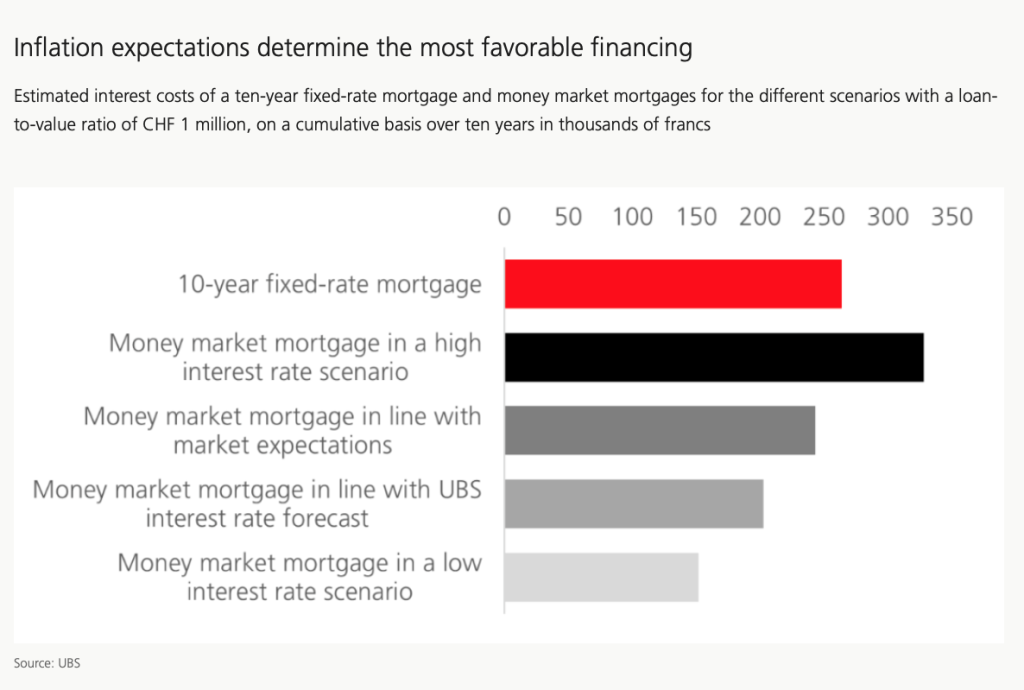

“Despite the current flat interest rate curve, UBS forecasts that money market financing over a term of ten years is likely to be the more favourable financing option compared to a ten-year fixed-rate mortgage. We estimate the interest cost advantage of the money market mortgage at just under a quarter of the cumulative interest payments of a ten-year fixed-rate mortgage.” Quote: UBS

UBS continues: “If, on the other hand, short-term interest rates rise somewhat in line with current expectations on the financial markets, the cost advantage of a money market mortgage is likely to dwindle to below 10 percent. If short-term interest rates were to rise even more strongly and persistently due to strong inflation concerns, the fixed-rate mortgage over a term of ten years represents the more favourable option.”

Conclusion: The right choice depends on individual factors.

The bank concludes: “The choice of the optimal mortgage financing depends on individual factors. The first question is what type of person you are. The more security-oriented you are, the more a fixed-rate mortgage with a long term is recommended.

There are also good reasons for a money market mortgage. If you choose a short term, you remain flexible. If you are suddenly tempted by a job offer abroad or if your family situation changes (divorce, children move out, etc.), you can sell your home in the foreseeable future without incurring an early repayment penalty.

In addition, it is open to mortgage borrowers to react regularly to interest rate changes and switch to a fixed-rate mortgage if necessary. To benefit from this, however, you need to keep up to date with the conditions on the market, which requires a certain interest and expertise.”