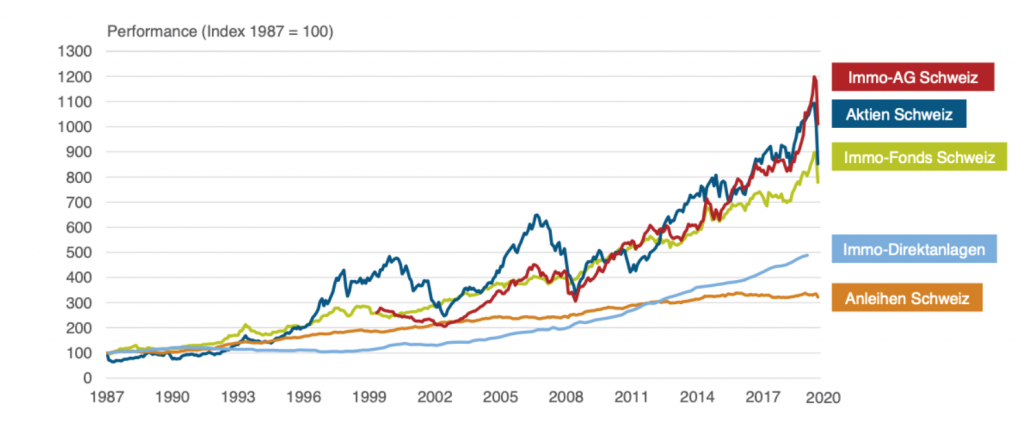

Direct investments in real estate have proved to be safe in recent decades, even in severe crises. He currently sees no reason why this should be any different in the current crisis, said Prof. Donato Scognamiglio, CEO of IAZI AG on the occasion of media conference on the Swiss real estate market development in 2019. High returns, such as those on the stock market last year, could quickly collapse in difficult times: 40 percent plus last year was impressive, but more than half of this had already melted away in the first three months of the current year. In contrast, direct investments in real estate (light blue in the chart) have been moving continuously upwards since 1987. The strongly negative effects of the current crisis on Swiss equities (dark blue curve) are also clearly visible:

Quelle: IAZI, SIX

Good figures for 2019 and moderate optimism for 2020

Although the year 2019 showed a positive trend, optimism naturally remains restrained in view of the worldwide corona developments. The key figures from the IAZI Swiss Property Benchmark, updated at the end of 2019 point to a reversal of the trend. Vacancies would have been reduced for all categories of investment properties. IAZI writes in its press release that this is due to a slight decrease in target rent. Nevertheless, the net cash flow has increased slightly, which can be explained above all by the postponement of investment costs.

As optimistic as the review for the past year is, the forecasts for 2020 remain uncertain. For a situation reminiscent of the Spanish flu in 1918, there are currently too few forecasts or scenarios to be able to measure the economic and medical consequences approximately, the paper continues.

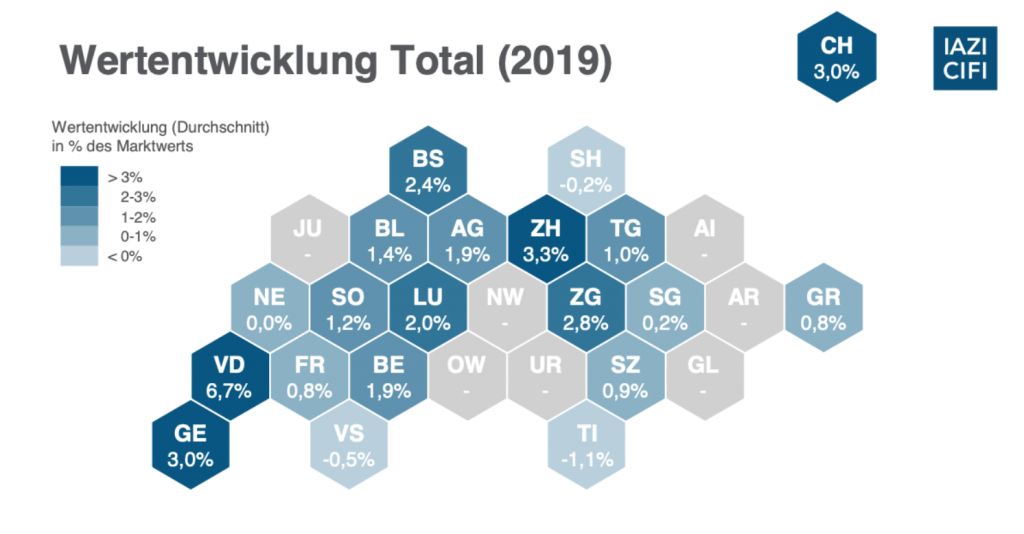

High revaluation of properties, low risk awareness on the part of investors

IAZI writes in the press release (free translation by Wüst und Wüst): “The performance of Swiss direct real estate investments has been very positive as of the end of 2019. The performance is the sum of the change in value plus net cash flow return in percent of the market value of the properties. It amounted to 6.2% at the end of 2019. In the previous year (2018) it was 5.3%. The increase in performance was approximately the same for all property categories. For residential properties, the performance was 7.1% (previous year: 6.0%), for mixed-use properties it was 6.2% (previous year: 5.4%) and for commercial properties 5.2% (previous year: 4.2%).

This growth in performance is due to a strong appreciation of the properties. The total performance at the end of 2019 was 3.0% (previous year: 2.0%). Residential properties showed the strongest change in performance with +3.9% (previous year: 2.8%); mixed-use properties showed 3% (previous year: 2.1%) and commercial properties 1.9% (previous year: 1.0%).

Quelle: IAZI