“Is the breather in the Swiss real estate market already over?” asks IAZI AG in its evaluations of transaction prices in the second quarter of 2023. Their conclusion: In the market for residential property, a strong willingness to pay continued to be observed after the end of the 2nd quarter.

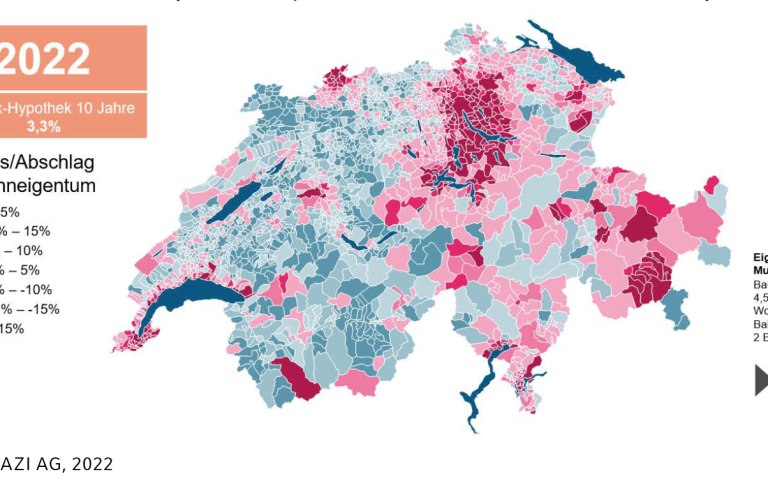

Average prices for owner-occupied homes in the country were 0.8% higher than in the previous quarter, according to the SWX IAZI Private Real Estate Price Index. Over the last twelve months, prices have risen by 4.8%. This is still well above the long-term trend.

Single-family homes were particularly popular with buyers in the second quarter. Transaction prices in this submarket recorded growth of 1.1%. The price curve for condominiums was somewhat flatter with a plus of 0.5%.

According to SWX IAZI Real Estate Indices for residential property and investment property, prices continue to rise. Source: IAZI AG

Multi-family houses were traded at 1.6% higher values in Q2 2023, as shown by the “SWX IAZI Investment Real Estate Price Index”. The values of residential investment properties are therefore already picking up again, after a brief sharp slowdown in the 1st quarter. The continued positive momentum is also reflected in the persistently high annual growth rate of 5.6%.

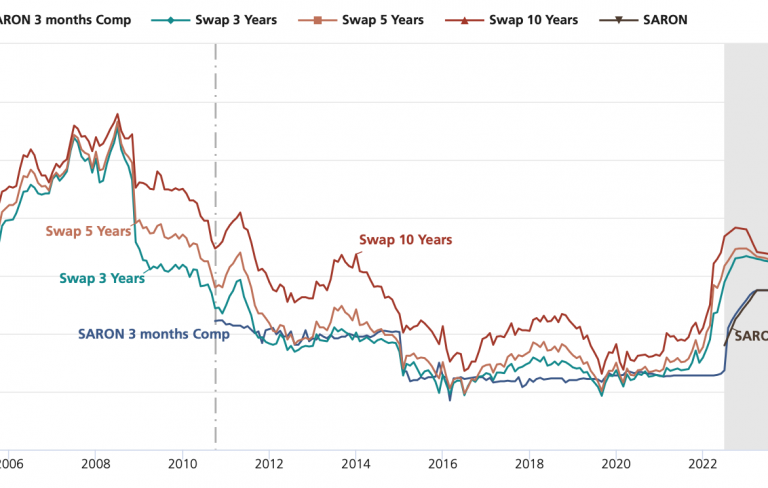

According to IAZI, real estate prices are rising despite higher interest rates and growing financing costs due to several factors: “Switzerland remains highly attractive as a place to live by international standards. An almost insatiable demand from companies for highly qualified workers with corresponding purchasing power and relatively low inflation are likely to lead to a record high level of labour migration in the current year. The additional demand is felt in both the owner-occupied and rental housing markets. Rising rents are having a supportive effect on multi-family home values. At the same time, housing supply is expanding sluggishly and an acceleration of construction activity is hardly realistic in the short term. The Swiss National Bank’s now small key interest rate hike to 1.75%, combined with long-term interest rates that have been stagnant for months, also suggests that borrowing costs are likely to stabilise.”

Watch the market commentary by Donato Scognamiglio, CEO of IAZI AG on YouTube here:

Only arm’s length transactions with mortgage institutions such as banks and insurance companies are taken into account when calculating the price indices. This measures the actual willingness to pay of interested parties in the market. The methodology thus differs from the valuations of properties in the portfolios of institutional real estate investors such as pension funds and insurance companies, which are in part more directly influenced by changes in key and capital market interest rates.