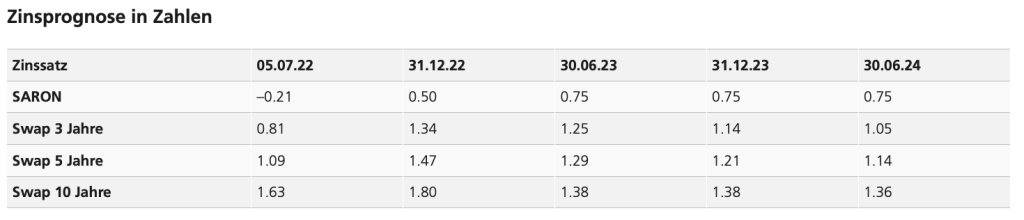

The Swiss National Bank (SNB) raised key interest rates by 0.5 percentage points to -0.25 per cent on 16 June, UBS writes in its latest interest rate forecast for mortgages. An increase in the key interest rates by the SNB had been expected, but only after the first expected interest rate step by the European Central Bank in July. The reason given by the Swiss National Bank for this early rate hike is that it wants to counteract the higher inflationary pressure in Switzerland. The SNB’s interest rate step is not likely to be the last, UBS believes. It expects the SNB to raise its key interest rates to 0.75 per cent by the middle of next year.

The surprise of the SNB (and also other central banks) has led to a significant increase in longer-term interest rates (e.g. 10-year), UBS continues in its article. In the last few days, however, fears of a recession have been responsible for an equally strong decline. UBS expects interest rates for Bunds and mortgages to move sideways in the coming quarters without a clear trend. However, in these uncertain times – for central banks and investors – high fluctuations in interest rates must still be expected.

Quellen: Bloomberg, UBS Switzerland AG; Bitte beachten Sie, dass es sich bei dem angegebenen Zinssatz teilweise um eine Prognose handelt und dieser sich sowohl nach unten wie nach oben verändern kann.