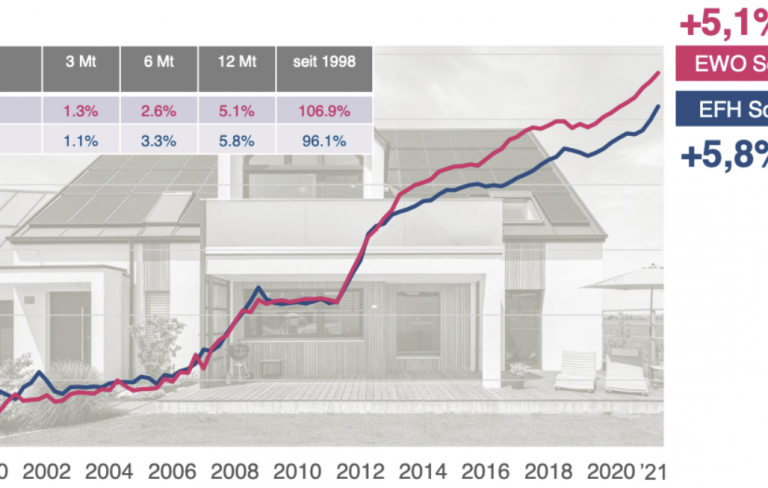

Demand for residential property remains robust for the time being despite higher interest rates, writes real estate valuation company IAZI AG in its latest release on the development of real estate prices in Switzerland in the second quarter. According to IAZI, prices paid on the market for owner-occupied homes continued to rise slightly in Q2 2022 at 0.7%, as shown by the “SWX IAZI Private Real Estate Price Index“.

Single-family houses (+0.6%) and condominiums (+0.8%) contributed almost equally to this price development. Over the past 12 months, the growth in transaction prices for residential property remains above the long-term average at 5.2%.

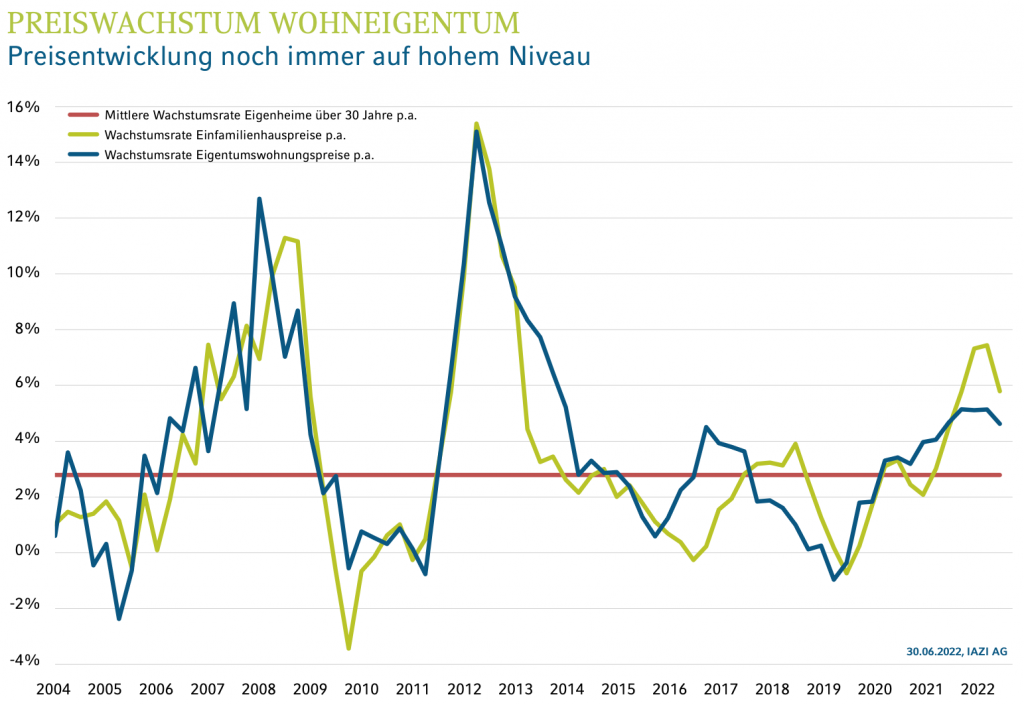

Growth rates of property prices are significantly above the long-term average. Source and chart: IAZI AG

“The most important price factors, such as immigration and the economic cycle, are stable,” says Donato Scognamiglio, CEO of IAZI AG. The cost of the popular long-term fixed-rate mortgages has risen, which is dampening demand. However, short-term money market mortgages (e.g. SARON) are still available at very attractive conditions. In addition, prospective buyers must already be able to cope with an interest rate level of around 5% due to the existing financing guidelines.

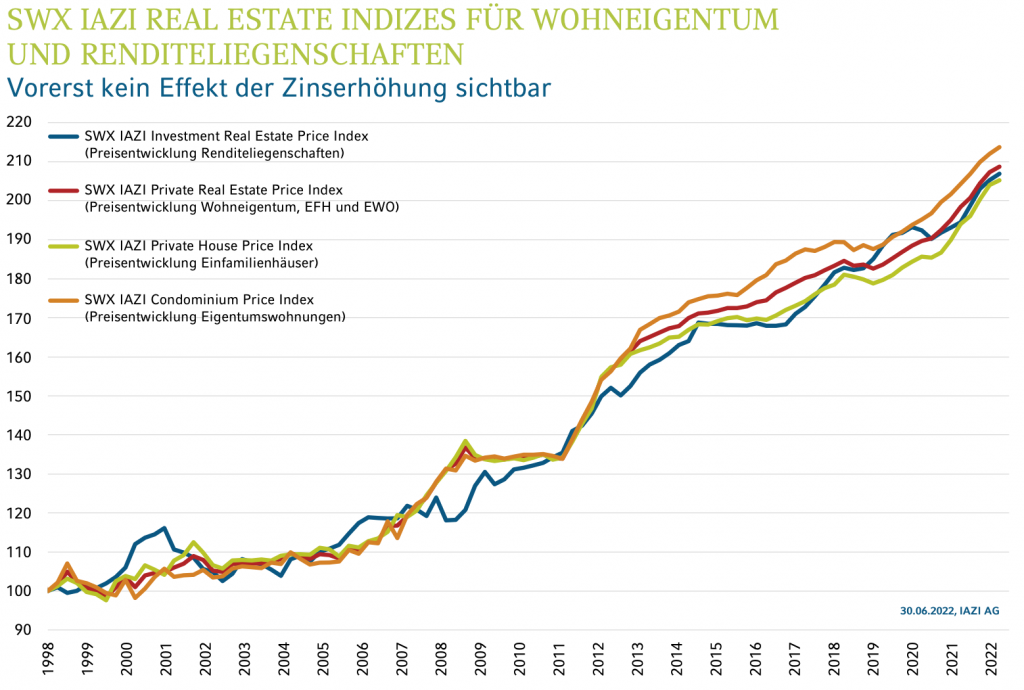

The willingness to pay for multi-family houses has also increased by 0.8% in Q2 2022, as the “SWX IAZI Investment Real Estate Price Index” shows. This also leads to a continued strong price growth of 6.4% on an annual basis. “For the time being, the market is unimpressed. But we see increased risks in investment properties,” says Donato Scognamiglio, because rising interest rates have a direct price-reducing effect on the valuation of such properties. “After the Swiss National Bank’s interest rate decision, real estate is no longer an alternative investment,” says Scognamiglio.

For the time being, no effect of the interest rate hike is visible, but even if the interest rate turnaround does not affect property prices for the time being, a cooling is to be expected in the medium term. Source and chart: IAZI AG

Even if the turnaround in interest rates does not affect real estate prices for the time being, IAZI believes that a slowdown can be expected in the medium term. Especially in the case of planned transactions of multi-family houses, market participants are likely to show greater restraint in the current environment. “The further development depends to a large extent on inflation and thus on possible further interest rate increases by the central banks,” says Scognamiglio.

See also the video interview with Prof. Dr. Donato Scognamgilio, CEO of IAZI AG: