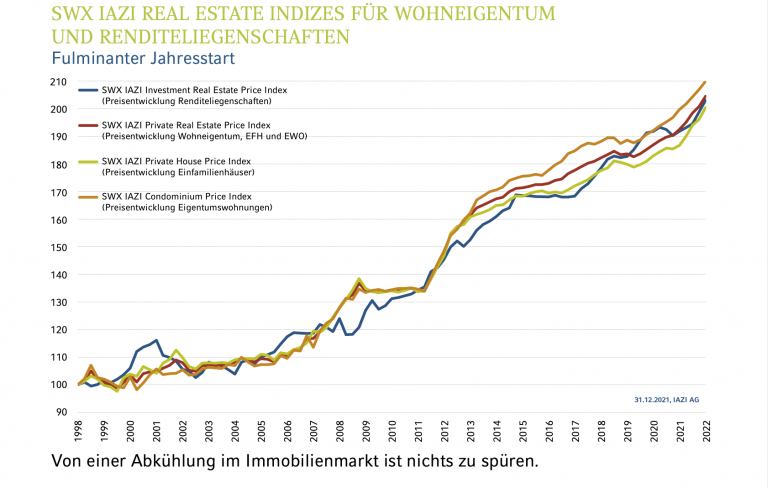

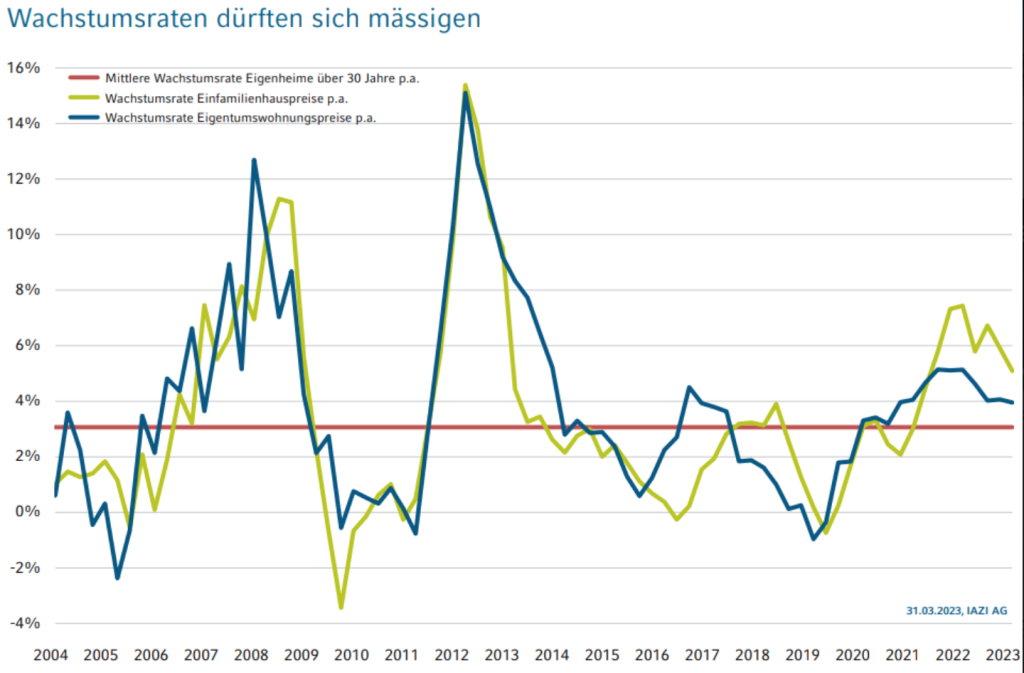

As the “SWX IAZI Private Real Estate Price Index” for residential property reveals, the owner-occupied housing market at the end of the first quarter of 2023 continues to be unimpressed by the changing signs on the interest rate front. Prices paid on the market rose again by 1.0 % compared to the previous quarter, with single-family houses (1.0 %) and condominiums (0.9 %) being virtually equally sought-after among buyers, writes IAZI. And further: “From a full-year perspective, the growth rate remains above average at 4.6 %. Regardless of the higher financing costs, homeowners-to-be are once again letting their dream of home ownership cost more. Especially in rural and peripheral regions, however, the peak in the owner-occupied home segment has probably been reached by now. In the coming quarters, a braking effect can therefore also be expected for home ownership.”

See also the video market commentary by IAZI CEO Donato Scognamiglio on YouTube:

Interest rate turnaround dampens transaction prices for multi-family houses

In contrast, according to IAZI, the progressive turnaround in interest rates has now definitely arrived in the Swiss real estate market for multi-family houses. The “SWX IAZI Investment Real Estate Price Index” shows that the price development of multi-family houses based on current market transactions has hardly changed at 0.4 % in the first quarter of 2023. This noticeable slowdown in price development was to be expected, as the turnaround in interest rates has increased the financing costs of real estate and at the same time made other investment options such as bonds and debentures more attractive from an investor’s point of view. Consequently, the willingness to pay for investment properties has slowed down considerably. In contrast, prices for investment properties have still risen by 4.8 % over the past twelve months, which can be attributed to the increases in the previous quarters.

Growth rates are likely to moderate. Quelle: IAZI AG

Nevertheless, IAZI remains optimistic. The euphoria surrounding concrete gold is thus dampened – at least for the time being. Nevertheless, real estate is still a worthwhile investment. IAZI says: “Due to the strong immigration and increasing housing shortage in the centres, rental income should continue to bubble up and even grow. Unlike in recent years, however, investors are no longer willing to pay ever higher purchase prices for this income. The change in sentiment is likely to continue as long as inflation values maintain their high level and the central banks continue their fight against inflation. This will has been reaffirmed by monetary watchdogs in Switzerland as well as around the globe in the latest round of interest rates.”