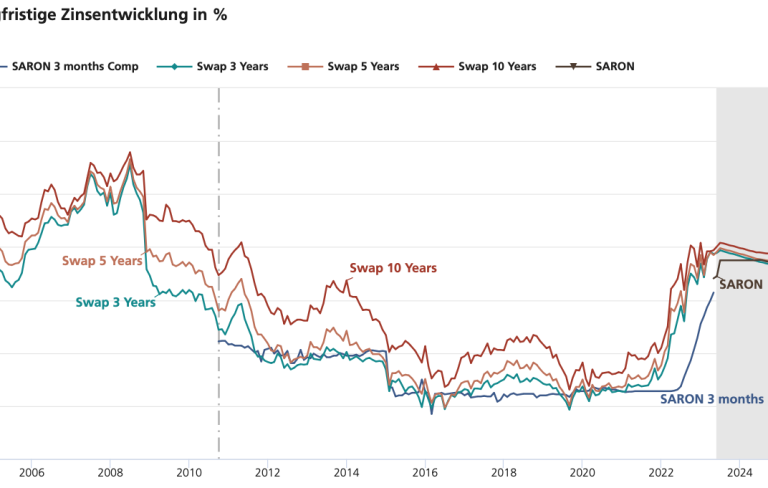

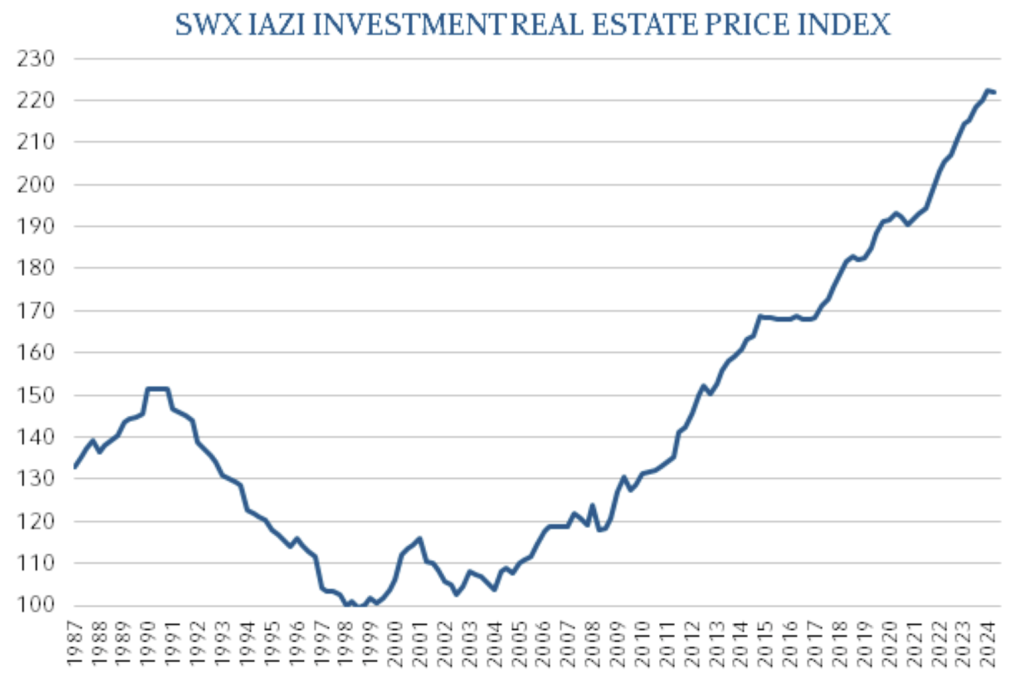

In its first quarterly report on the real estate year 2024, IAZI AG writes that residential property remains in demand, but homebuyers’ willingness to pay seems to know limits. The prices of freehold transactions rose slightly again in the first quarter of 2024. However, at +0.6%, the increase was significantly more moderate than in previous quarters, as the “SWX IAZI Private Real Estate Price Index” shows. Over the last twelve months, this results in further declining but still above-average price growth of +4.2% for owner-occupied homes.

SWX IAZI Private Real Estate Price Index, Quelle: IAZI

Watch the market assessment by Donato Scognamiglio, Chairman of the Board of IAZI AG, on YouTube here:

Further slight growth in the market for private residential property

Buyers of single-family homes were prepared to pay +0.7% higher prices than in the previous quarter. The fact that single-family homes are somewhat more sought-after than condominiums is also confirmed from an annual perspective: at +4.6% compared to the same quarter of the previous year, house price growth remains high, while apartment prices are slowly approaching the long-term average at +3.7%.

There is still excess demand on the owner-occupied housing market due to the glaring shortage of supply. In addition to the low level of construction activity, there has also been a recent decline in sales of existing properties. In terms of affordability, demand for owner-occupied homes has also fallen. These factors are having a dampening effect on the market. The number of condominiums traded is significantly higher than that of single-family homes. This form of home ownership is also more affordable. This suggests that buyers are increasingly switching to condominiums.

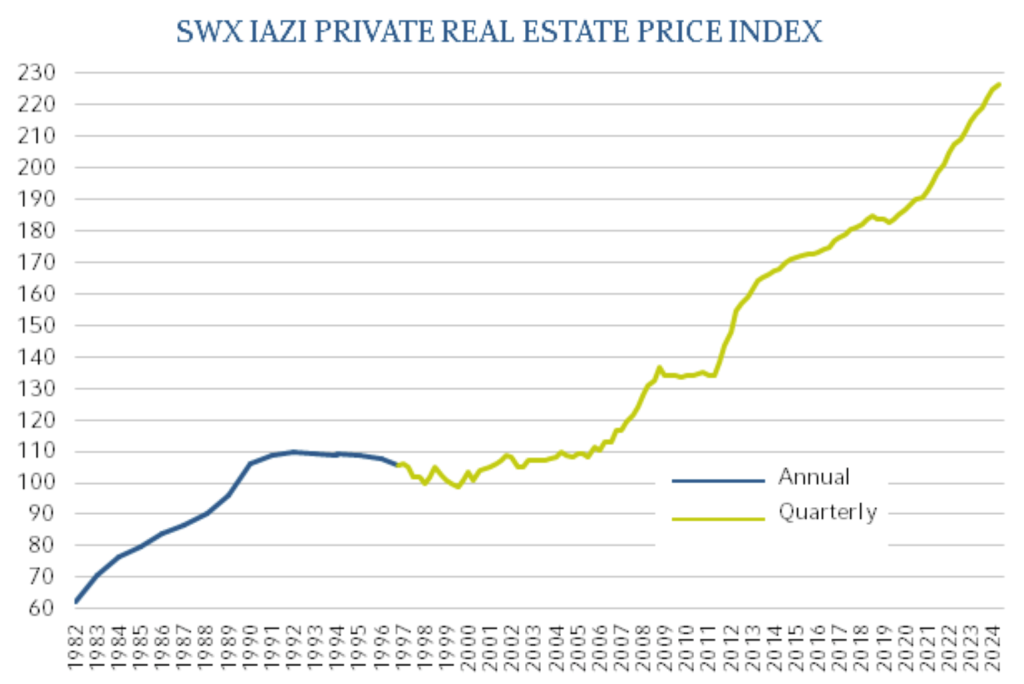

Prices in the market for investment real estate fall slightly

The current market situation for investment properties is different: These changed hands at -0.1% lower values in the 1st quarter of 2024, as shown by the “SWX IAZI Investment Real Estate Price Index”. This stabilization of multi-family house prices, at least for the time being, corresponds to the first decline in willingness to pay for several years. Over the past twelve months, investment properties have continued to achieve robust price growth of +3.2%, but here too there is a clear downward trend.

SWX IAZI Investment Real Estate Price Index, Source: IAZI

Andere Anlageklassen, wie beispielsweise erstklassige Anleihen, konkurrenzieren solche Immobilien-Direktanlagen aufgrund der schwindenden Renditevorteile mittlerweile deutlich stärker. Institutionelle Anleger investieren zwar weiterhin in Renditeimmobilien, sind aber deutlich preissensitiver und wählerischer beim Kauf von Liegenschaften. Kriterien wie die Lage, der bauliche und energetische Zustand der Liegenschaft oder der Mieter-Mix werden zunehmend wichtiger.

IAZI Swiss Property Benchmark® weist auf Wertkorrekturen bei Geschäfstliegenschaften

Bei der Messung der Mehrfamilienhauspreise wird auf effektive Markttransaktionen von Wohn-, aber auch Geschäftsliegenschaften abgestützt, die mit Fremdkapital via Bankfinanzierung durchgeführt werden. Diese reine Transaktionssicht unterscheidet sich von der Bewertungsmethodik, die institutionelle Immobilienanleger wie Versicherungen oder Pensionskassen für ihre Liegenschaftsbestände anwenden. Hier zeigt die jährliche Auswertung des IAZI Swiss Property Benchmark®, dass im Jahr 2023 Wertkorrekturen bei Geschäftsliegenschaften vorgenommen wurden, während die Werte von Wohnobjekten stagnierten.

There is a noticeable slowdown in price increases for residential property, source: IAZI

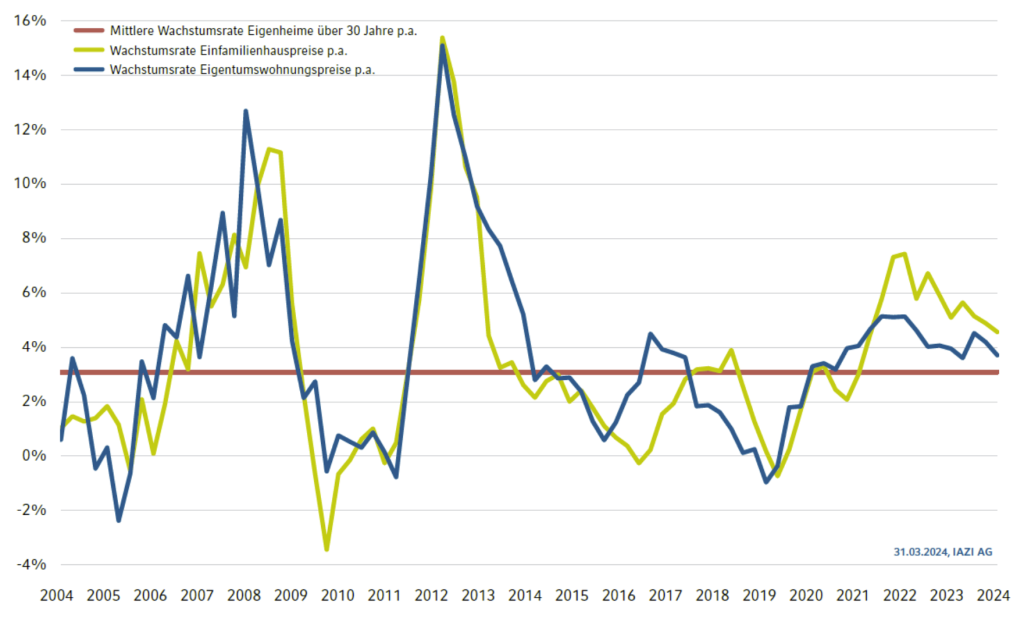

Overall, therefore, the Swiss real estate market is currently showing signs of easing. However, it remains to be seen whether this will last. The key interest rate cut decided by the Swiss National Bank at the end of March could, depending on further developments, channel more capital back into the real estate market and increase price pressure.