The sideways trend in yields on Swiss government bonds and mortgage interest rates that has been ongoing since March continued in May, writes UBS in a recent assessment of the situation. The bond markets continue to assume that the Swiss National Bank (SNB) will lower the key interest rate to 1 per cent in the next 12 months.

The bank writes: “The SNB will meet on 20 June for its next monetary policy assessment. While the US economy is performing better than expected and the first interest rate cuts are therefore not likely to take place until the second half of the year, the European Central Bank has already indicated that it intends to cut key interest rates in June, which also makes a further interest rate cut by the SNB likely. At 1.2 per cent this year and 1 per cent next year, Swiss inflation is likely to be well within the SNB’s target range. Against this backdrop, the current key interest rate of 1.5 per cent is a little too high, which also speaks in favour of a rate cut.”

Sources: Bloomberg, UBS Switzerland AG; values up to and including 2010 are based on Libor and from 2011 onwards on SARON. The effective interest rate of the product is calculated from the margin + compounded SARON of the respective accounting period. For the calculation of the interest rate, the compounded SARON can never be less than zero.

The bank concludes from this that “the SNB will lower the key interest rate to 1.25 per cent in June. A further rate cut is likely to follow in September. As the bond market is already factoring the expected interest rate cuts into its prices, longer-term Swiss interest rates are likely to continue to trend sideways in the coming quarters. Mortgage rates linked to SARON, on the other hand, are likely to benefit from two further interest rate cuts by the SNB in the coming quarters.”

This means that the reference interest rate relevant for rents is also unlikely to rise any further in the coming months.

Long-term development uncertain

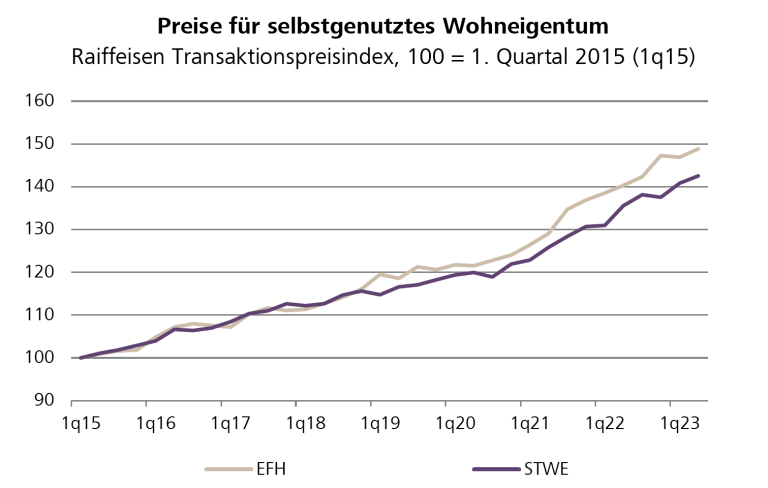

As the chart above shows, interest rate trends have been characterised by fluctuations in recent years. For example, the last trend reversal took place in 2022 and was characterised by

- the increase in key interest rates by the SNB and other central banks due to the sharp rise in inflation as a result of the Russian attack on Ukraine

- the further increase in key interest rates in the fight against continuously rising inflation rates towards the end of 2023, inflation in Switzerland fell significantly, causing yields to fall sharply as key interest rates were expected to be cut again.

- actual yields that have already priced in the interest rate cuts expected for this year.