Raiffeisen Switzerland is convinced that Swiss rental law leads to massive disincentives and inefficient use of scarce living space. Its property study for the first quarter of 2024 also shows that buying will soon become more attractive than renting again as a result of falling interest rates and that the housing shortage will worsen due to immigration and the construction slump. However, an optimised allocation of space could free up 170,000 rental flats of 100 m² each.

“The Raiffeisen property study for the first quarter of 2024 also shows that buying will soon become more attractive than renting again as a result of falling interest rates.” Source: Raiffeisen

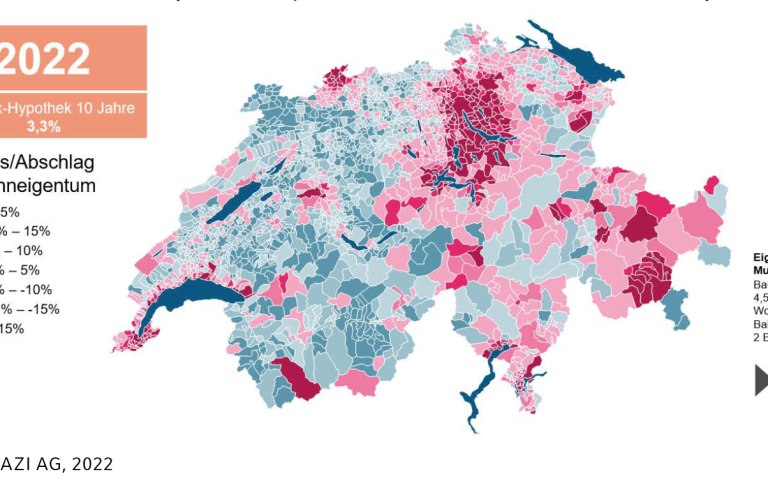

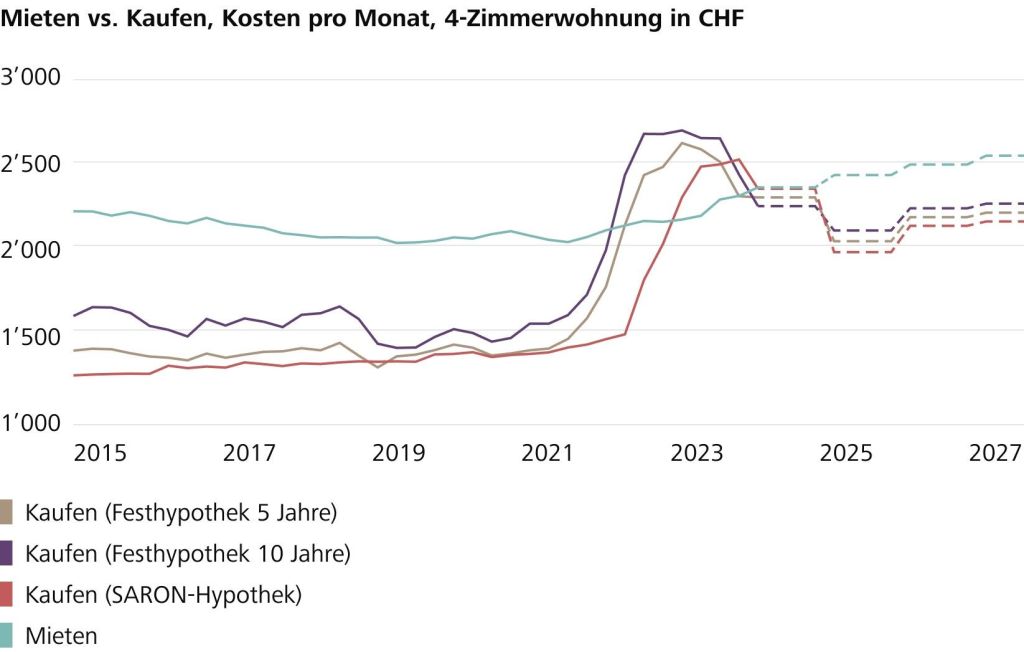

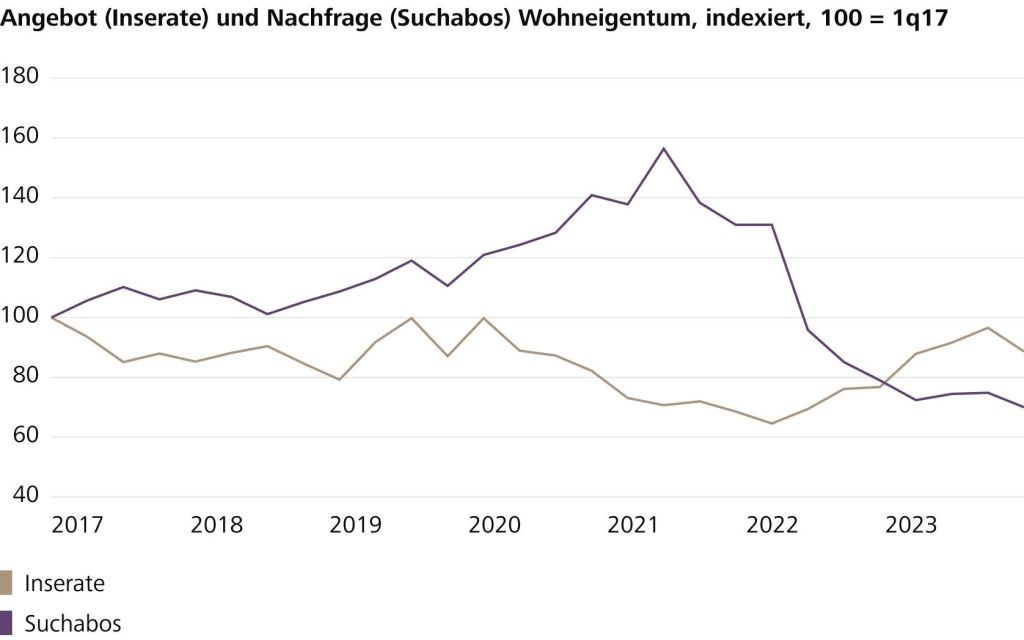

Fredy Hasenmaile, Chief Economist at Raiffeisen Switzerland, explains: “The rise in interest rates has reduced the financial incentives to buy property, as buying is currently more expensive than renting. However, this situation will probably turn out to be a brief intermezzo. With the prospect of falling key interest rates from the second half of the year and sharply rising rents, the housing cost advantage of owning a home is likely to return in the medium term. The Raiffeisen analysis shows that the slowdown in price momentum in the market for owner-occupied residential property continued towards the end of last year. Within two years, price growth has more than halved, which can be attributed to reduced demand since the interest rate turnaround. Nevertheless, the first signs of a stabilisation of the cooling process can also be seen. The passing of the interest rate peak has somewhat reduced uncertainty on the buyer side. Whether price growth will slip into negative territory over the course of the year is on a knife-edge. Significantly more properties are currently being advertised for sale than during the pandemic. The price expectations of sellers and buyers are often diverging, as the former are sticking to their price expectations. This manifests itself in a longer advertising period and a noticeable decrease in the number of actual property changes.

Bleak prospects for tenants

In its press release, Raiffeisen paints a gloomy picture for tenants. The Swiss population is growing at a high rate, driven by immigration, which last year saw a record of around 100,000 net foreign immigrants. As a result, demand for housing is also growing at a time when the production of new flats is at its lowest level for 20 years. He continues: “In more and more regions, the signs of scarcity are becoming more pronounced. The number of advertised properties across Switzerland has halved in just one and a half years. In contrast, the annual growth in rents has accelerated to an average of 4.7 per cent. The surplus vacancies of the last decade are slowly being reduced, leaving many tenants to dig deeper into their pockets. Difficulties in finding accommodation and rapidly rising new rents will remain a reality on the rental housing market for some time to come.

The demand for housing is growing at a time when the production of new flats is at its lowest level for 20 years. In more and more regions, signs of a shortage are becoming more pronounced. The number of advertised properties across Switzerland has halved in just one and a half years. Source: Raiffeisen Real Estate Study 1st quarter 2024)

Nevertheless, there is still no sign of any reaction from the construction side. “Obviously, the investment prospects are still not sufficient to overcome the prevailing structural problems of housing supply in the form of an acute shortage of building land and sluggish densification. Rental price growth will exceed general price growth for the foreseeable future, even though interest rates are already falling again,” predicts Fredy Hasenmaile. There is only good news for existing tenants. Thanks to the recent peak in interest rates and the prospect of key interest rate cuts in the near future, last December’s rise in the mortgage reference interest rate is likely to be the last for the time being.”

Current tenancy law leads to grotesque misallocation

According to Raiffeisen, the current tenancy law freezes rents at the closing price and allows few reasons for adjustments. Although this regulation unilaterally protects existing tenants from higher costs, over time it leads to an increasing decoupling of asking rents from existing rents. This is not without side effects: “The price differences, which are particularly pronounced in the centres, generate false incentives by penalising households for a reduction in living space instead of rewarding them. Even after a short rental period, a change to a slightly smaller flat for a new tenancy costs more than the previous existing rent. As a result, people are not downsizing. “Senior households in particular often live in flats that are too large for their needs. More than half of tenants over the age of 60 have at least two more rooms than household members,” says Hasenmaile. Such households are also becoming more numerous, which is why the average living space consumption per capita is constantly increasing – it currently stands at 46.6m². At the same time, the number of households that have to cram themselves into overcrowded flats is growing. The disincentives also encourage vacancies and tenant mobility that is too low.

The expected strong growth in new rents over the next few years will further exacerbate the problem. The current optimisation potential for better allocation alone is huge. In its property study, Raiffeisen Economic Research states that if all rental flats had just one more room than the number of people living in the household, an “ideal” space consumption of around 38 m² per capita could be derived. A more efficient allocation of space would not only solve the problem of overcrowding, but would also free up an additional 170,000 rental flats of 100m² each. This would create living space for almost half a million people. Better utilisation of the rental flat park could therefore largely alleviate the worsening housing shortage without having to construct a single new building. “In view of the enormous, unused potential, it would be appropriate, particularly from an ecological and social point of view, to address the causes of the misallocation under tenancy law on the one hand and to boldly consider how a sensible transfer of space could be achieved on the other,” suggests Hasenmaile.

If you would like to know more, you can download the entire Raiffeisen Real Estate Study as a PDF here. (in German only)