The avobis Group recently published its interest rate expectations online. It writes that the latest consumer price data from the USA has also brought a certain degree of calm to the Swiss interest rate markets. Despite a slight rise in inflation in Switzerland in April, the SNB will almost certainly implement a second interest rate cut; however, the company does not currently expect a rate cut in the USA before the summer break. For the ECB, however, the interest rate market is already pricing in a full interest rate cut for June.

The national consumer price index; source: avobis, May 16, 2024

Here are the detailed assessments from avobis:

Interest rate development Switzerland

“The latest consumer price data from the USA has also brought a certain degree of calm to the Swiss interest rate markets. Despite the higher inflation data from Switzerland in April, the SNB will almost certainly make a second key interest rate cut in June. However, compared to the previous month, a lower probability of a third rate cut by the end of the year is currently being priced in. This assessment is probably best explained by the weaker franc and the expected persistence of inflation. In our view, however, a third cut this year will be unavoidable as soon as the ECB and then the Fed start easing and the franc appreciates again in real terms despite currency purchases.”

Market expectations & forecasts for the SARON rate and SNB key interest rate; source: avobis, May 16, 2024

Interest rate development abroad

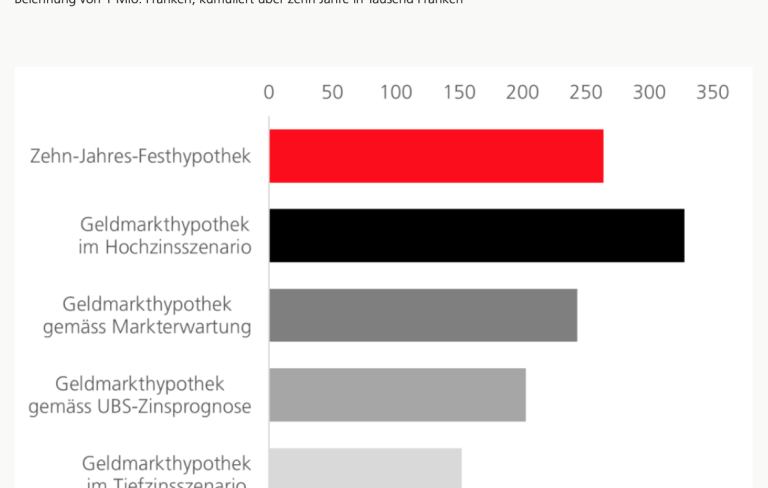

“Expected figures are good figures – this is how the US bond and equity markets reacted to the latest inflation data, which finally ended the four-month phase in which inflation was always higher than forecast. This did not necessarily make interest rate cuts any more likely, but discussions about potential rate hikes are likely to become less important. Meanwhile, the ECB is preparing for a possible rate cut. In our assessment of the interest rate market in May 2024, we show what these developments mean for monetary policy and mortgage rates and how the situation is assessed in Switzerland and abroad.”

More details and information can be found in the PDF, which you can download here.