The real estate valuation company IAZI AG recently published the “SWX IAZI Private Real Estate Price Index” for private residential property (single-family houses and condominiums) for the 1st quarter of 2021. And once again it surprises with another increase (1.3 % compared to 1.1 % in the previous quarter). According to IAZI, a year ago, the forecasts for the real estate market were still fraught with some uncertainties on the occasion of the first Covid 19 lockdown. One year later, the certainty that the market has so far proven to be crisis-resistant in times of the pandemic is strengthening, the company writes on its website. In addition, the price dynamics have clearly shifted from investment properties to private residential property.

Transaction prices for private residential property

The housing preferences created in the pandemic have given a big boost to the demand for the cottage in the countryside. Source: IAZI AG

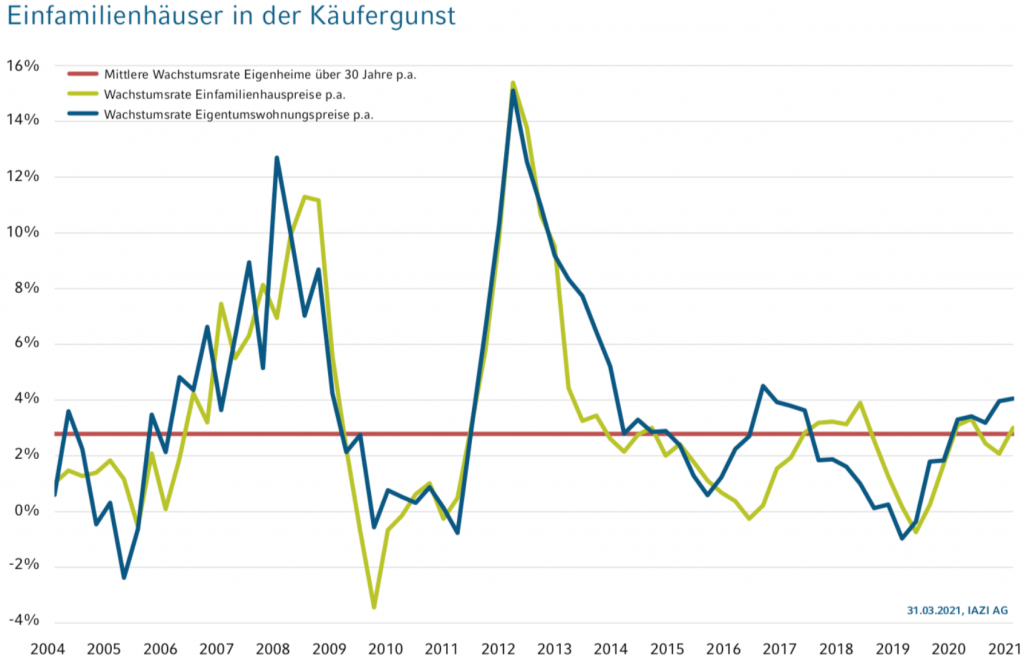

Above all, the revived desire for an idyllic house in the countryside is helping the market for single-family homes to record-breaking growth rates. Single-family homes showed price growth of 1.7% in the first quarter (previous quarter: 0.7%). “IAZI has not seen such strong price growth in this segment since 2013,” said Donato Scognamiglio, CEO of IAZI AG. “The housing preferences created in the pandemic, i.e. the desire for more greenery and for more space, has given a strong boost to demand,” Scognamiglio added. On an annual basis, growth is 3.0% (previous quarter: 2.1%).

Compared to single-family homes, condominiums grew less strongly by 1% in the first quarter (previous quarter: 1.5%). Nevertheless, price growth on an annual basis is still 4.1% (previous quarter: 4.0%).

Offer prices for single-family houses

The “Swiss Real Estate Offer Index” tracks the development of offer prices and offer rents. The annualised growth in asking prices for single-family homes is 7.2% (previous quarter: 5.6%). This is the highest increase since the index was first calculated. “Interestingly, this very high demand meets a small supply of properties, which has boosted sellers’ price expectations,” says Donato Scognamiglio. For years, he says, the market has focused on the construction of high-yield rental flats. In addition, the detached single-family house no longer fit well into the densification scenario of some communities.

Beat Hürlimann, CEO of Wüst und Wüst, fully agrees with IAZI’s data analyses regarding the price development of luxury real estate and the declining supply of upscale properties in his recent comment.