Interest rates remain low – or continue to fall.

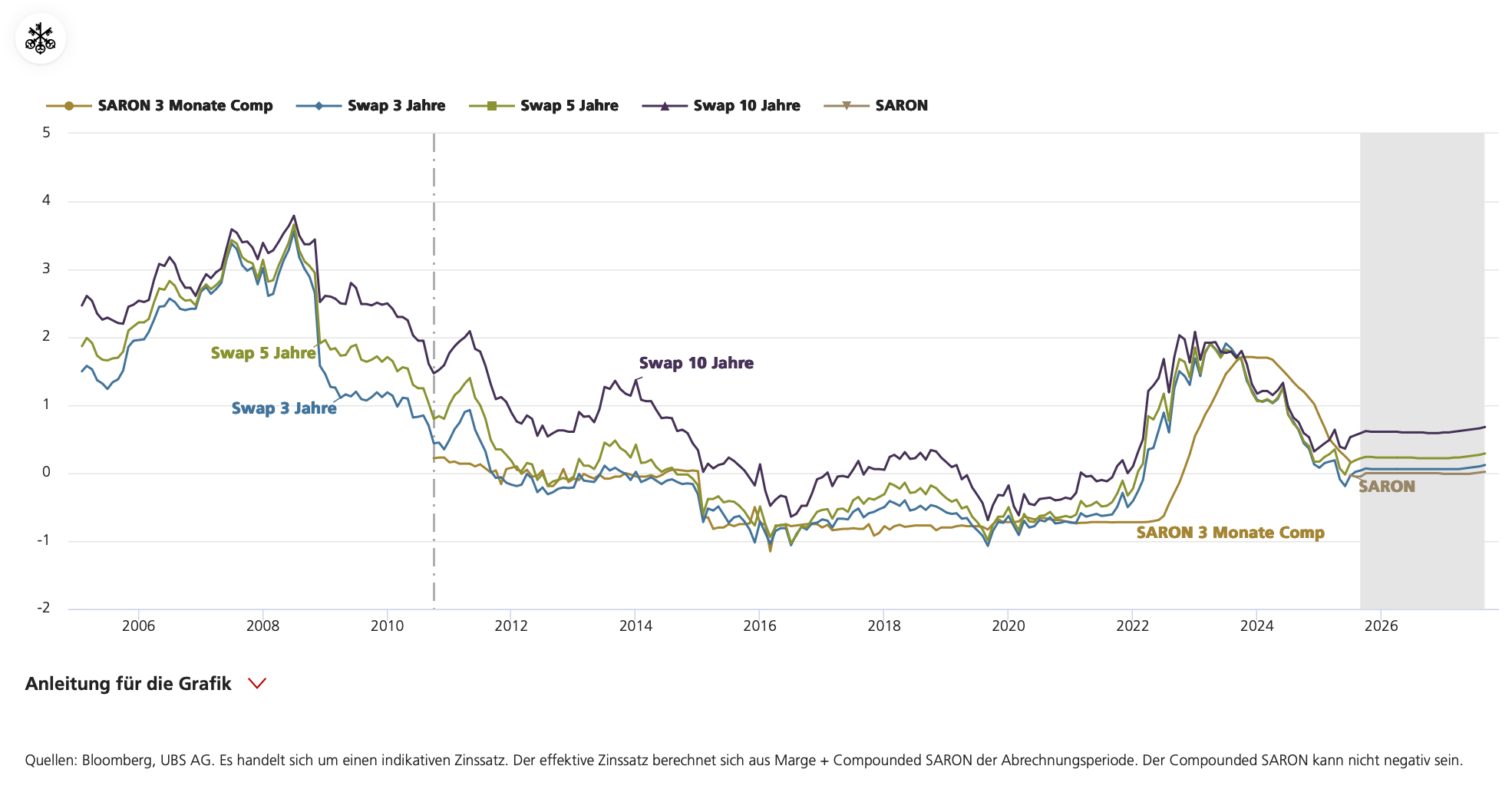

04.08.2025UBS recently published its interest rate forecast for the second half of 2025. It assumes that, following the Swiss National Bank’s decision in June to lower its key interest rate by 0.25 per cent to 0 per cent as part of its monetary policy analysis, no further cuts are to be expected. Since then, longer-term interest rates have risen, both for government bonds and mortgages, the bank writes.

UBS sees the reason for this in the assumption that, prior to the assessment of the situation, the financial markets had expected not only an interest rate cut to 0 per cent in June, but even further interest rate cuts in the second half of the year. However, after Swiss National Bank President Martin Schlegel stated that the hurdle for interest rate cuts into negative territory was higher than for previous adjustments, the financial markets’ expectations of further interest rate cuts declined significantly. As a result, interest rates on government bonds and mortgages rose slightly.

As the SNB had already responded to the rather weak economic performance and low inflation in Switzerland with its latest interest rate cuts, it is likely to keep interest rates stable. The bank believes that surprises on the financial markets are likely to be limited, as expectations of further interest rate cuts had already been significantly scaled back after the SNB’s last assessment of the situation. According to UBS’s interest rate forecast, Swiss government bond yields and mortgage rates should therefore remain within the current range in the coming quarters. Mortgage rates linked to SARON are also likely to remain stable.

However, UBS concludes its analysis of interest rate developments with a major caveat that has become abundantly clear in recent days: the considerable uncertainties surrounding US trade policy. The bank writes: “If, contrary to our expectations, the trade dispute does not stabilise in the coming months, the global economy could slump.” However, contrary to UBS’s expectations, this is precisely the scenario that has now become reality for Switzerland on 1 August. In this case, according to the bank’s forecast, “it would be more likely that the SNB would reintroduce negative interest rates and that longer-term Swiss interest rates could fall further.”