Will the SNB’s key interest rates turn negative again?

18.09.2025Since America started imposing exorbitant tariffs on Swiss products, our prosperity seems to be in jeopardy. The export industry in particular is likely to suffer from massive competitive disadvantages on the American market. Even if the quality of our products is convincing, the significantly higher prices of almost 40 per cent due to the expensive franc and customs duties may cause some US customers to look for alternatives.

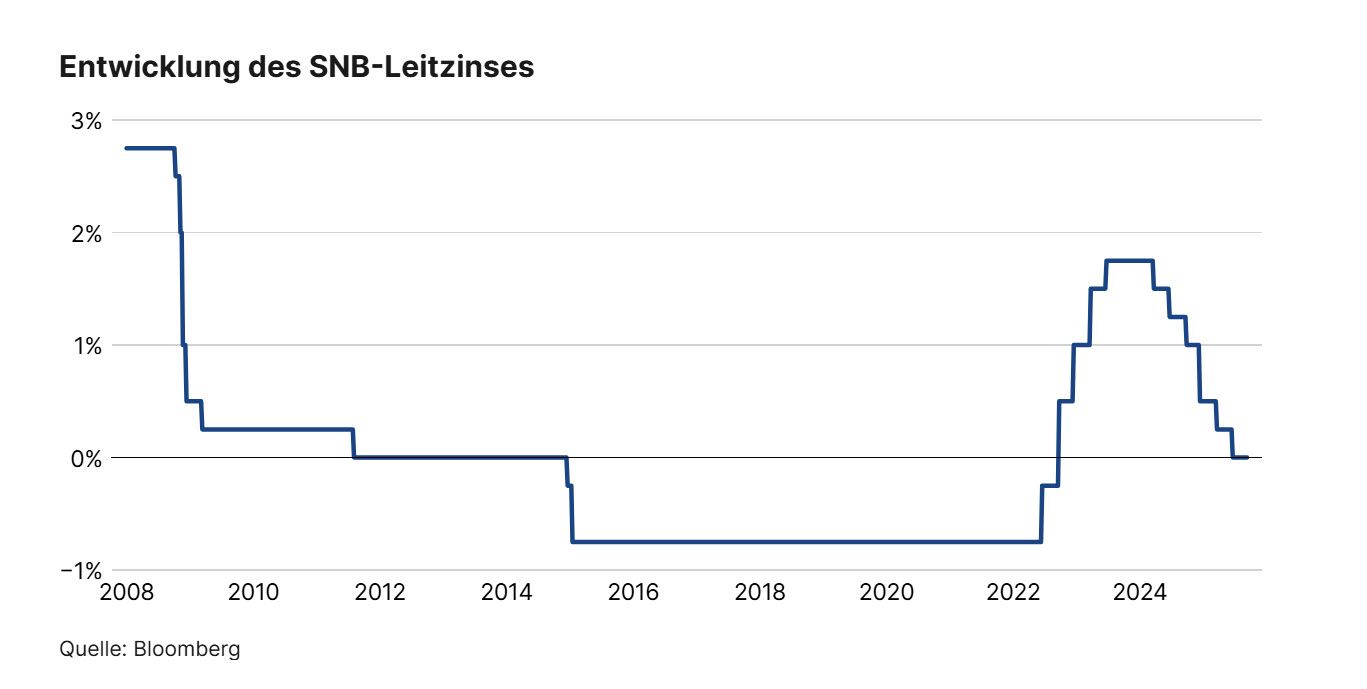

The Swiss National Bank could do something to counter the feared slowdown in the Swiss economy: further reduce interest rates and thus reintroduce negative interest rates.

There is currently intense speculation as to whether or not it will do so in its next interest rate round in a week’s time. However, according to Christoph Sax, Chief Investment Officer at VZ VermögensZentrum, there are some good reasons not to.

Firstly, a further reduction in the key interest rate could hamper the Federal Council’s efforts in negotiations with the US on lower tariffs to prevent greater pressure on drug prices. Sax writes: “The introduction of negative interest rates by the SNB would send the wrong signal in this environment. Negative interest rates could possibly be classified as currency manipulation by the US.”

Secondly, inflation remains stable at a low level, currently standing at 0.2 per cent in August. Although the strength of the Swiss franc has led to falling import prices, a widespread decline in consumer prices is not foreseeable, writes VZ.

And thirdly, although SNB President Martin Schlegel does not categorically rule out negative interest rates, he recently pointed out that the hurdle for a return of the key interest rate to negative territory is higher than before. Negative interest rates would have undesirable side effects, including for pension funds and the property market.

Therefore, VZ concludes, it is “unlikely that the pressure to act is high enough from the SNB Governing Board’s point of view – especially since interest rates in the eurozone and the US are significantly higher, which is holding back upward pressure on the Swiss franc. It is therefore most likely that the SNB will not lower its key interest rate any further. This applies both to the decision on 25 September and to the next decision in December.”

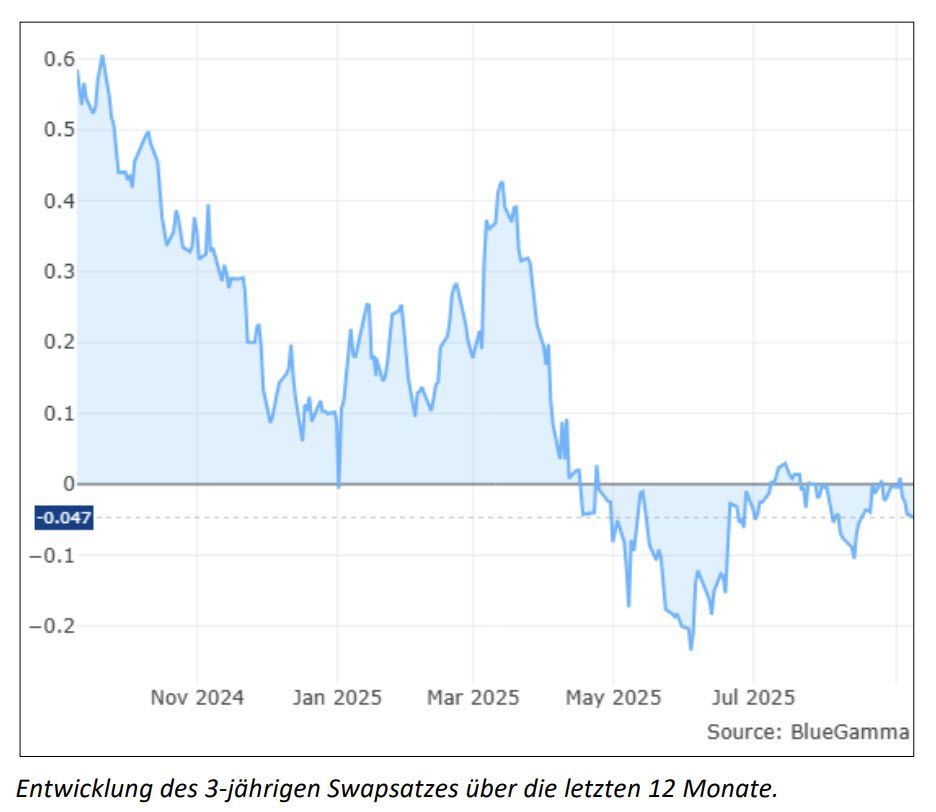

This is also the conclusion reached by avobis; in its “Einschätzung Zinsmarkt September 2025”, the company writes that the majority of market participants expect the SNB meeting on 25 September to result in a zero round in two senses: no further interest rate cuts and maintenance of the current key interest rate level of zero per cent. “A further interest rate cut into negative territory is conceivable, but this would require the Swiss franc to appreciate even more,” writes avobis.

avobis continues: “For the Swiss property market, this means that financing conditions will remain attractive for the time being, even if banks control their profitability through higher interest margins.”

Decisions by the most important central banks

As expected, the European Central Bank (ECB) decided on 11 September not to change its key interest rates for the eurozone. The deposit rate, which is particularly important for savers, remains at 2.0 per cent. The deposit rate therefore remains at 2.0 per cent. In spring 2024, it was still twice as high at 4 per cent. On 17 September, the US Federal Reserve and, finally, on 25 September, the SNB will announce their decisions on future interest rate policy. According to avobis, “market participants in the US, on the other hand, are highly likely to expect an interest rate cut. Jerome Powell himself held out the prospect of such a cut at a symposium in Jackson Hole. The main question currently under discussion is whether the reduction will be 0.25% or even 0.5%. The Fed chairman is currently in an unfortunate situation. On the one hand, the latest US labour market data clearly show that the US economy is threatening to cool down. On the other hand, high tariffs are driving up prices. In addition, pressure is mounting at the political level, led by President Trump, who has been vehemently calling for an interest rate cut for months.