Study “Rethinking residential mobility” by the BWO.

10.06.2025On behalf of the Federal Office for Housing BWO, the ZHAW School of Management and LAW has summarized the findings of a four-year series of studies on residential mobility in Switzerland in an interim report. It also contains recommendations for action for private individuals, market players and the public sector. The report is available as a management summary, an abridged version and a full version in PDF format. The latter is particularly interesting with regard to possible models and solutions.

Residential mobility

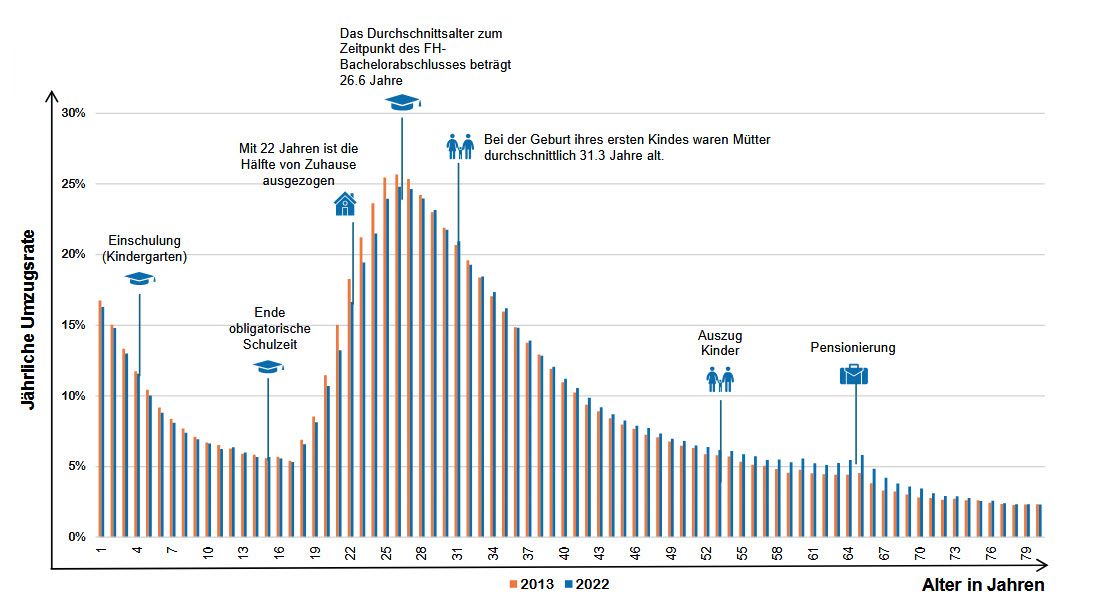

Residential mobility in Switzerland follows clear patterns over the course of a person’s life – and this has always been the case. While young adults move frequently, motivated by starting a career, starting a family or the desire for more living space, the willingness to move decreases significantly as people get older. Older people are more likely to remain in living situations that no longer best suit their needs. This is not only of their own volition, but also because existing structures reward stability more than change.

Mortgage financing, for example, is designed for long-term sustainable use, and existing tenancies are often cheaper than comparable offers on the market. In view of the current housing shortage, however, reduced residential mobility in old age can pose increasing social challenges.

Desire for ownership and downsizing in old age

There is a central area of tension between the desire for home ownership and downsizing in old age. Home ownership is considered desirable by many but is associated with financial hurdles. Rising real estate prices, strict financing requirements and a limited supply make it difficult for younger households to buy.

At the same time, many older owners are holding on to large residential properties, even though downsizing could be beneficial – for example, in terms of their quality of life. While young households are actively looking for improvements, older households often face uncertainties and decision-making hurdles. In many cases, a move is delayed because the immediate benefits are not clearly perceived or there are no suitable alternatives.

Best agers reduced to “living in old age”

The target group of best agers in particular – i.e. people aged between 45 and 79 – is reduced too much to traditional “living in old age”. The market has so far offered too few solutions to address the above-mentioned challenges. For best agers, there is a lack of flexible and attractive housing options that enable downsizing without any loss of quality. Many people in this age group are looking for flexible forms of housing that are tailored to their active lifestyles.

Large scope at municipal level

There is great potential at municipal level to take a more active approach to housing design. Municipalities could actively shape the local market in order to promote concepts for flexible housing models. At the interface with state regulation, too little use is currently being made of local freedoms. At state level, housing policy is faced with a dilemma: between security (regulation) and freedom (market freedom). The state must consider individual interests, but also social interests. For example, an expansion of home ownership subsidies could help to ensure that more people can afford home ownership. At the same time, however, this could also jeopardize financial market stability by leading to increased household debt and a potential overheating of the market.

Conclusion

Overall, residential mobility is not just a question of individual choice, but is also significantly influenced by market dynamics and political framework conditions. A rethink towards more flexible housing and financing models (e.g. The development of new forms of housing (e.g. temporary home ownership, building rights models, community-based forms of ownership and rent-to-own models) and more targeted government incentives could help to make the housing market more sustainable and adaptable. In particular, the dynamics of the rental, ownership and financial markets must be considered together, as they influence each other.