Real estate continues to grow.

21.10.2025At the end of each quarter, real estate valuation company IAZI AG reports on the ‘health’ of the Swiss real estate market. And the good news is that, according to these quarterly reports, the market has been on an upward trend for years. This was also the case in Q3/25.

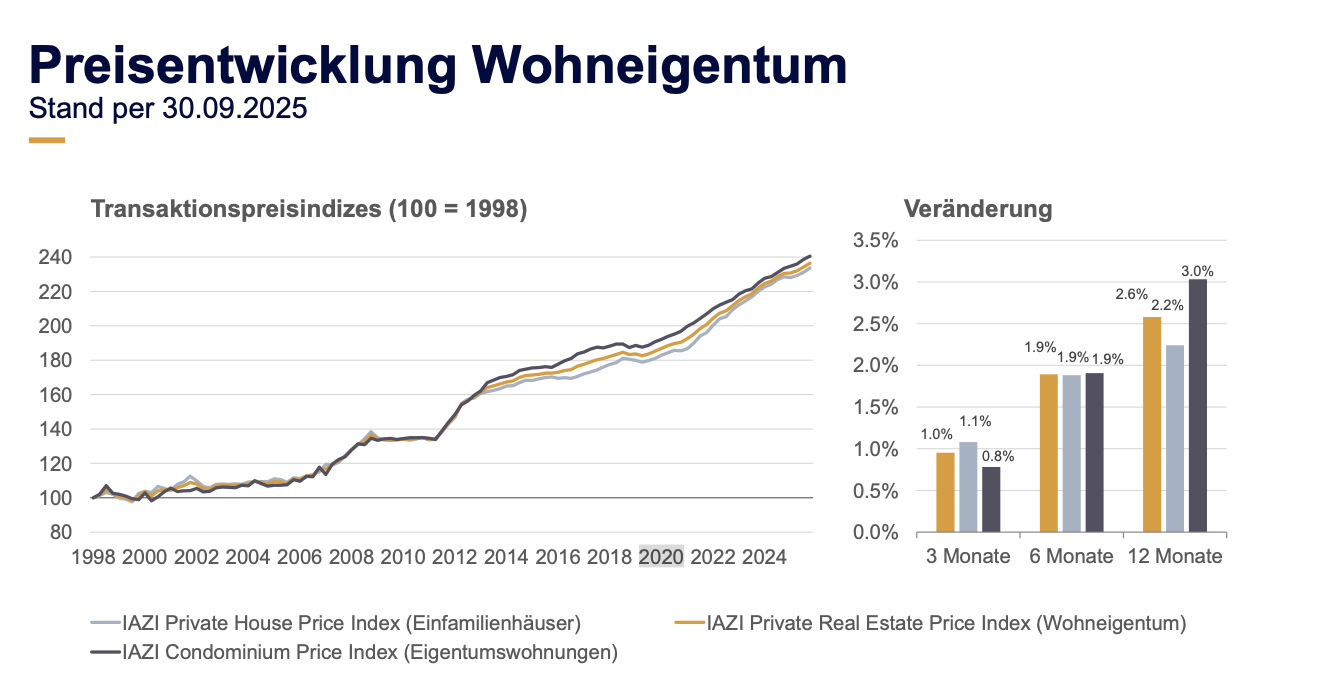

IAZI writes: “Prices for residential property continued to rise in the third quarter of 2025. Buyers paid 1.0% higher prices than in the previous quarter, as shown by the “IAZI Private Real Estate Price Index”. On an annual basis, this represents a 2.6% increase in prices for owner-occupied homes. The willingness to pay for single-family homes grew slightly more strongly at 1.1% than for condominiums (0.8%).”

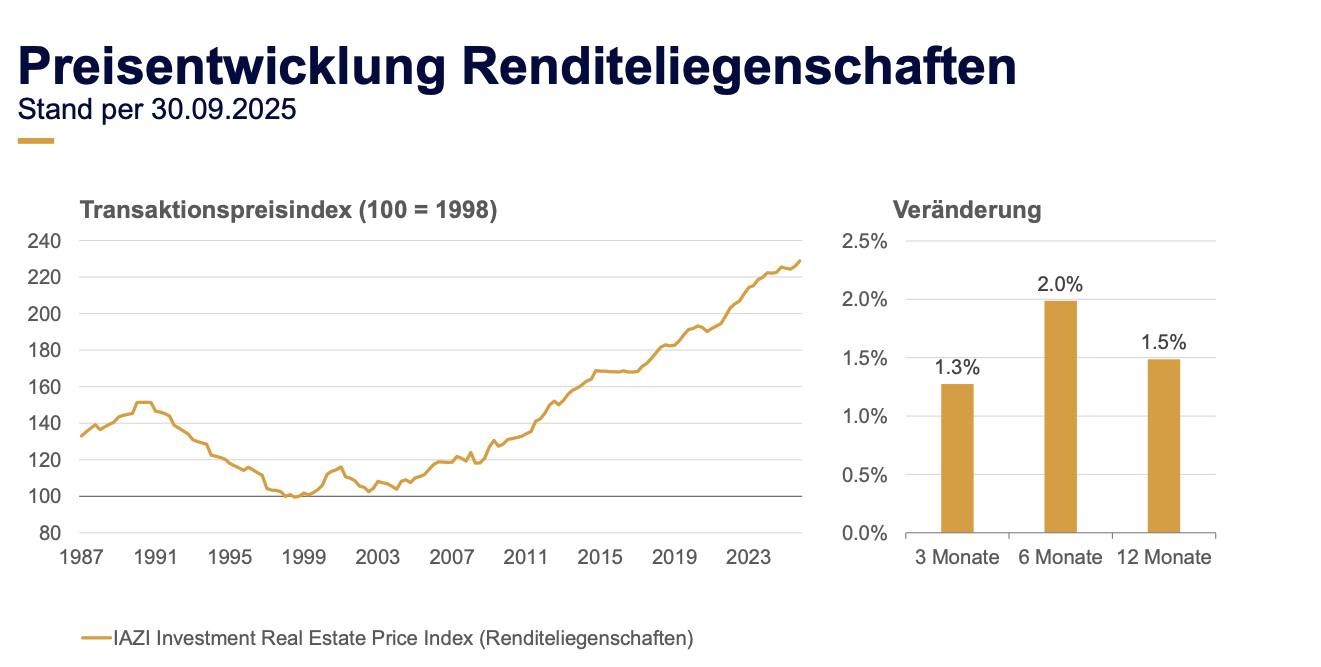

The positive trend also continued for investment properties, according to the company. According to the IAZI Investment Real Estate Price Index, transaction prices for multi-family dwellings and mixed-use properties rose by 1.3% in the third quarter, indicating a noticeable increase in demand. From an annual perspective, this resulted in only slightly stronger growth of 1.5%, which is well below the long-term average of 3.0% since 1998.

Watch the market commentary by Donato Scognamiglio, Chairman of IAZI AG, on YouTube.

National Bank’s low interest rate policy as a driver

According to IAZI, the Swiss National Bank’s expansionary zero interest rate monetary policy remains a key driver of this development. This increases the relative attractiveness of investment properties compared to fixed-income securities. Added to this is the reputation of Swiss real estate as a safe investment in a time of geopolitical uncertainty. Global power shifts, military conflicts, trade barriers and growing government debt in many Western countries reinforce Switzerland’s advantages as an investment location.

Abolition of imputed rental value has only marginal effect

The abolition of imputed rental value offers property owners the prospect of welcome financial relief; however, it is likely that this political decision will only have a marginal impact on price developments in the property market. Immigration, low interest rates and the shortage of building land remain the key drivers

US tariffs cloud the economic outlook

According to IAZI, however, the outlook is clouded by US tariffs on Swiss exports, which are now also set to include pharmaceutical products. These account for more than half of all exports (excluding precious metals). In Basel-Stadt, pharmaceuticals account for around 80% of exports, a significant proportion of which are exported to the US. The company fears that the manufacturing industry could also be affected in cantons such as Nidwalden, Neuchâtel, Aargau, Valais and Vaud, where exports to the US account for more than 20% of total exports. However, it remains unclear whether and to what extent this development will affect the property markets. It is likely, however, that companies will react cautiously and exercise restraint, particularly in their personnel planning.

Declining immigration possible

Labour market-driven immigration, which is already below the previous year’s level in 2025, could therefore weaken further in the coming months. However, a noticeable decline in demand for housing would only be expected in a significantly more negative economic scenario, and there are no signs of this happening at present: although economic growth is hardly forecast for the second half of 2025, a recession is not expected. However, the company believes that individual regional markets for commercial and industrial space could come under pressure due to restructuring and company bankruptcies.