Raiffeisen: Report on the real estate market.

29.05.2025Raiffeisen Switzerland recently published its report “Immobilien Schweiz – Q2 2025” entitled “Ungeliebter, aber notwendiger Ersatzneubau” which you can download here as a PDF file (in German language only). As always, this quarterly report contains a wealth of information about the current state and predicted development of the Swiss real estate market. A brief summary of the study’s key findings is available here, also as a PDF in German language.

The key findings at a glance

The study provides valuable information on the economic framework conditions and current uncertainties in connection with global changes resulting from US trade policy. It shows that although the noticeable upturn in rental housing construction is encouraging, it is far from sufficient to bring about a stabilization. The study states: “However, it is highly questionable whether the high construction levels of the past can be achieved again, even with negative interest rates, as regulatory hurdles and limited building land continue to dampen potential.”

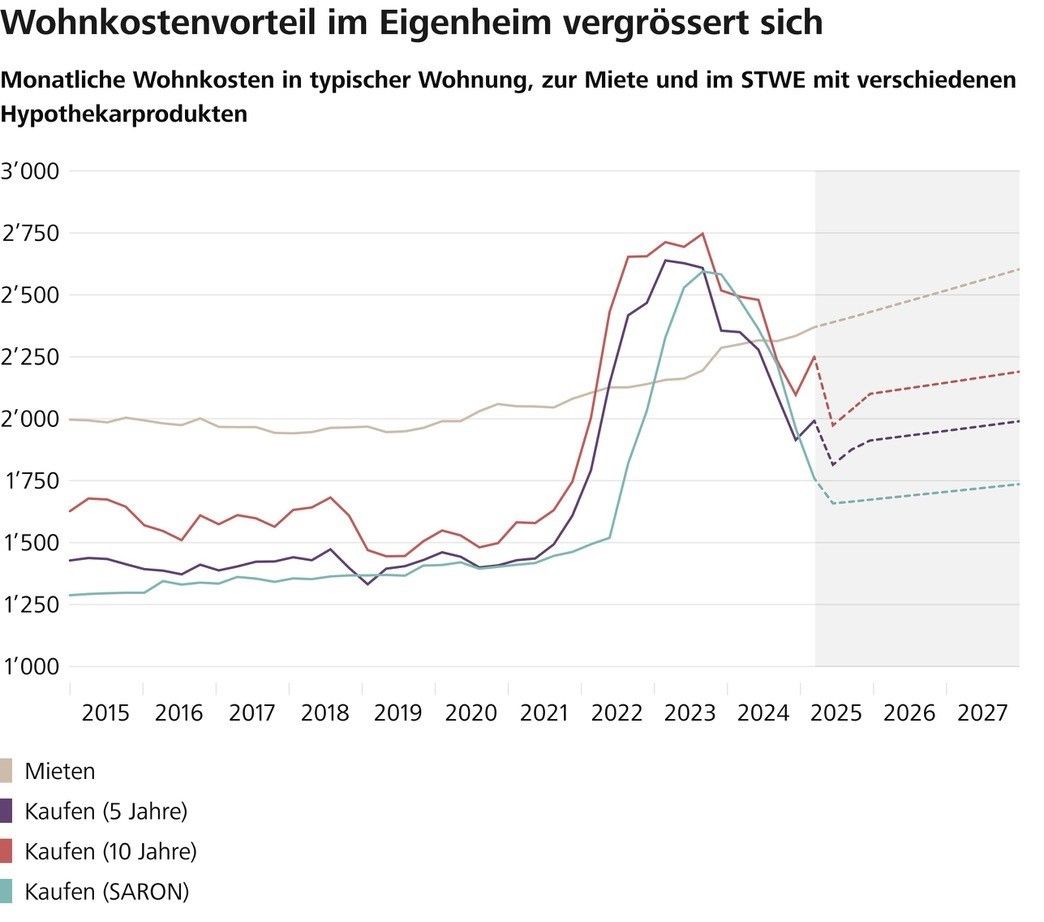

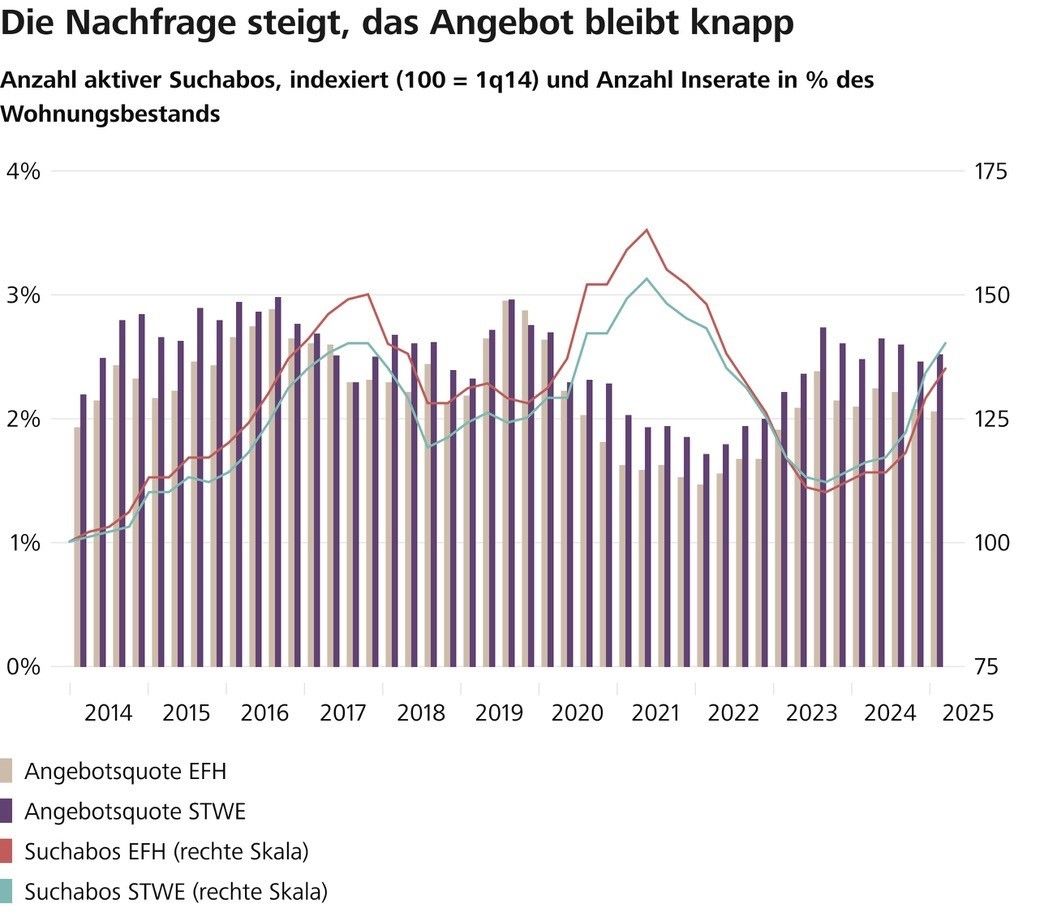

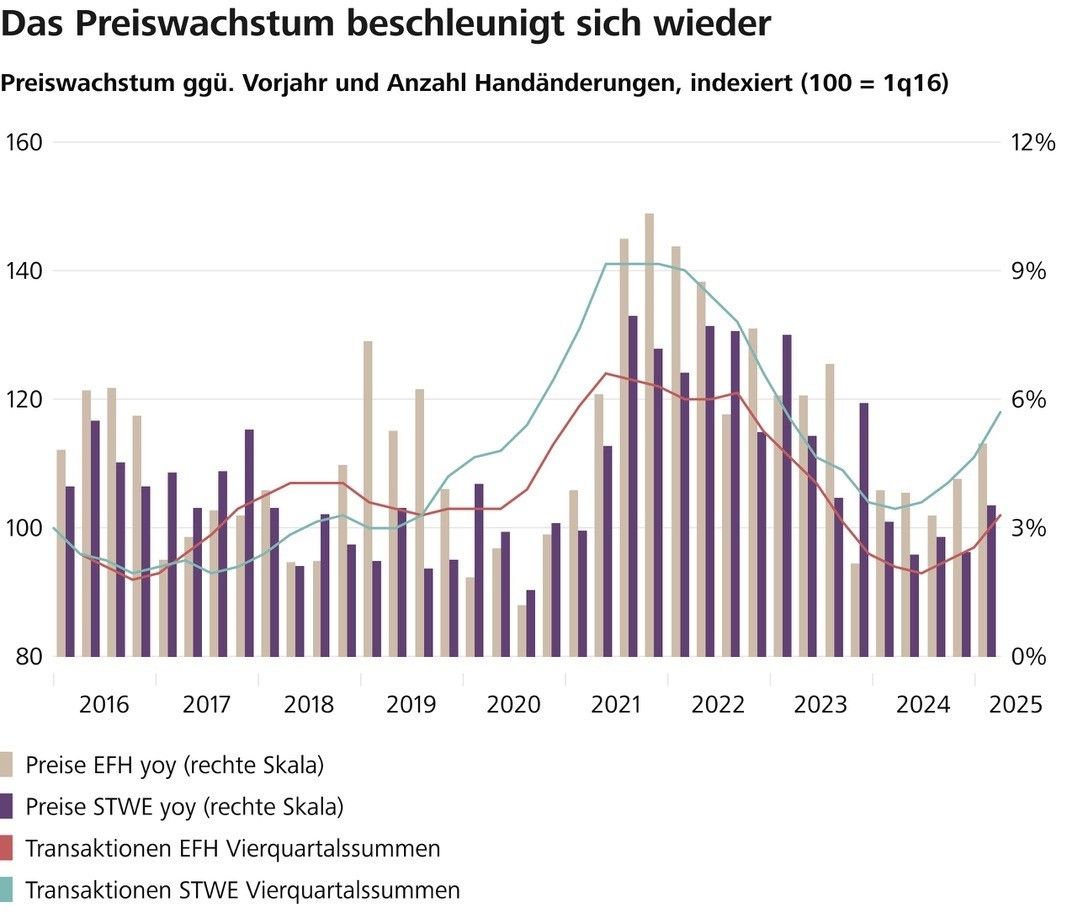

In the home market, the increasing financial attractiveness of home ownership compared to renting due to low interest rates is causing a sharp rise in demand for property and motivating many households to buy. As a result, the home market is bottoming out and seeing a noticeable increase in property sales, while mortgage lending is growing significantly from a low level. Raiffeisen also notes that prices are picking up again.

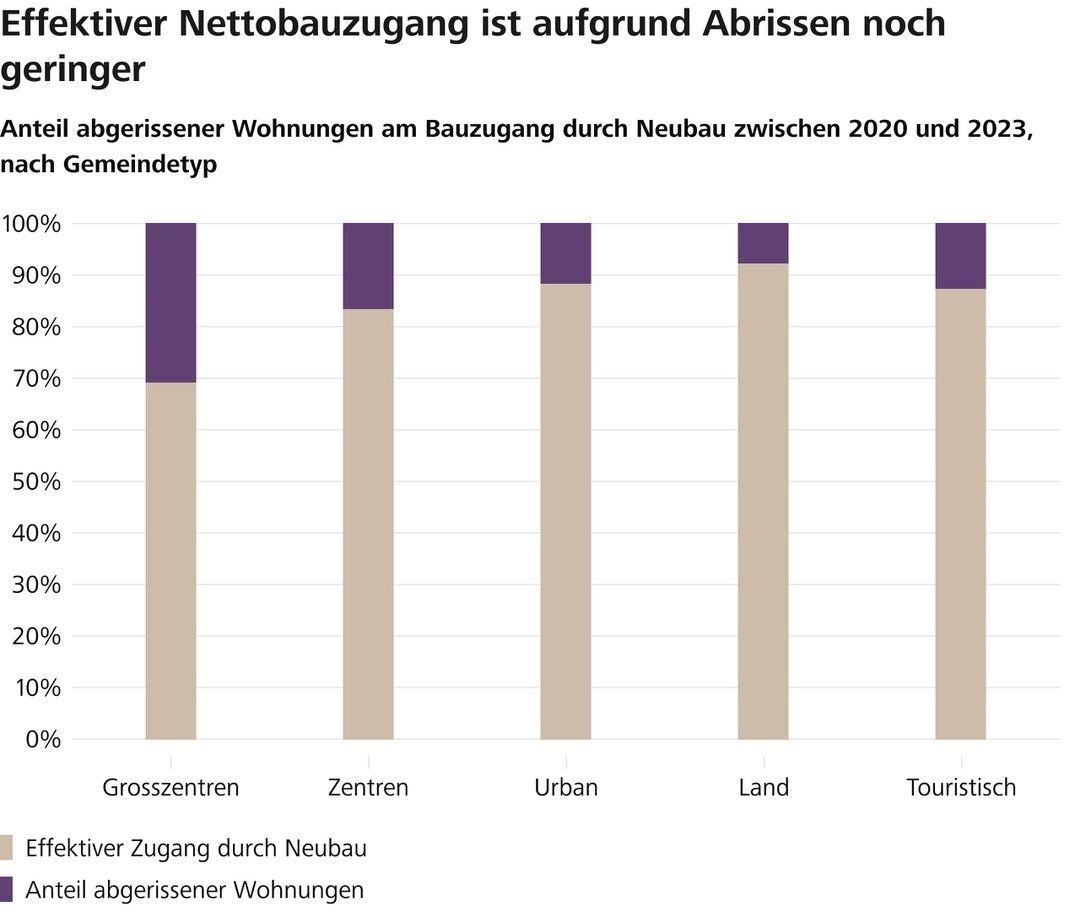

According to Raiffeisen, the growing demand for housing requires a significant increase in “unpopular” replacement construction to increase supply. However, this is controversial because, although this would create an average of four new apartments for each one demolished, it would also mean the disappearance of affordable old apartments, and the new apartments would mostly be more expensive. According to the study, in order for replacement construction to remain socially acceptable, “greater attention must be paid to social and ecological compatibility.” It is clear that it is not possible to simultaneously secure affordable housing, preserve old building structures, and limit land expansion.

Raiffeisen market assessment at a glance

The study summarizes the most important facts about the current market situation in a few keywords, which we quote here verbatim:

Demand

- Population: In the first three months of this year, the international migration balance of the foreign resident population in Switzerland was 3% lower than in the same period last year. As a result, demand for additional housing remains high.

- GDP: After modest GDP growth of 0.9% last year, we do not expect growth momentum to pick up in 2025, with growth also forecast at 0.9%. The high level of uncertainty caused by US trade policy and the industrial recession in Germany are weighing particularly heavily on export-oriented industrial companies.

- Income: Due to very low inflation, households will see a respectable increase in real wages in 2025. Private consumption will continue to prove a reliable pillar of support for the economy as a whole.

- Financing environment: With the expected key interest rate cut to zero, money market mortgages will become even cheaper. Interest rates on fixed-rate mortgages are likely to remain at their very low levels and trend sideways for the time being.

- Investments: Very low interest rates and sharply rising rents have once again made real estate investments significantly more attractive than fixed-income asset classes. More capital is already flowing back into concrete gold.

Supply

- Construction activity: In 2024, the number of apartments in building applications submitted increased by 3,400 (+7%) compared with the previous year. However, to alleviate the housing shortage, project activity would have to increase further and remain at a higher level for several years.

- Vacancies: Vacancy and supply rates are now so low that they are gradually reaching their lower resistance levels and thus losing their significance as indicators of scarcity. The scarcity is currently manifesting itself in a consolidation of households in the existing housing stock and in continued high rental price dynamics.

Price outlook

- Ownership: Financed with a money market mortgage, home ownership will soon be around a third cheaper than renting. Even with fixed-rate mortgages, the savings are considerable. This housing cost advantage is driving demand for owner-occupied homes and causing prices to rise sharply again.

- Rents: Existing tenants can expect a further reduction in the reference interest rate in fall 2025. However, asking rents will continue to rise sharply due to the ongoing shortage of housing.