Home ownership without retirement savings?

12.05.2025A representative survey of the Swiss population conducted by Raiffeisen Switzerland and the ZHAW School of Management and Law shows that 57 percent of people who do not own their own home dream of owning their own four walls. Among 18- to 30-year-olds who do not own their own home, almost three quarters (74%) would like to own a house or apartment in the future. Demand for home ownership is high, but rising prices mean that those who want to buy their own home need more and more financial resources. Because savings alone are often not enough, people are increasingly resorting to their retirement savings.

You can download the results of the study as a PDF file here (in German language only).

Without pension savings, it is often not enough

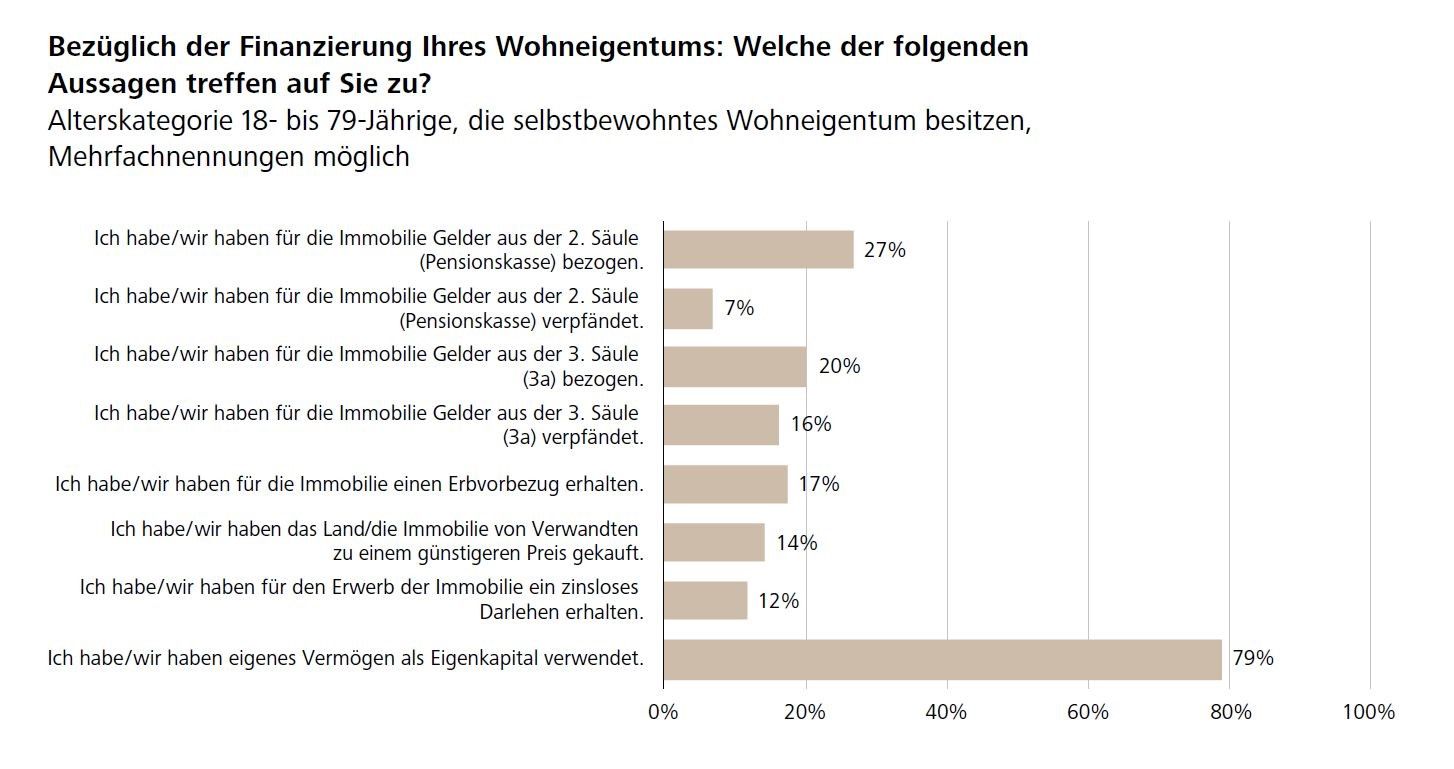

45 percent of those surveyed have already been able to fulfill their dream of owning their own home. More than two-thirds of them (68%) had to rely on additional sources of financing in addition to their own savings. An important role is played by the early withdrawal of funds from the second and third pillars, known as home ownership promotion.

Pension funds are increasingly being used to purchase residential property, as the example of pillar 3a shows. Of homeowners who purchased their own home before 2000, only seven percent used funds from pillar 3a to finance their home. Since 2011, this figure has risen to 33 percent. The survey shows that at the time of the survey, 20 percent of homeowners surveyed had withdrawn funds from pillar 3a and 16 percent had pledged them. In the case of the second pillar (pension fund), 27 percent opted for early withdrawal and seven percent for pledging.

Waiving repayment carries risks

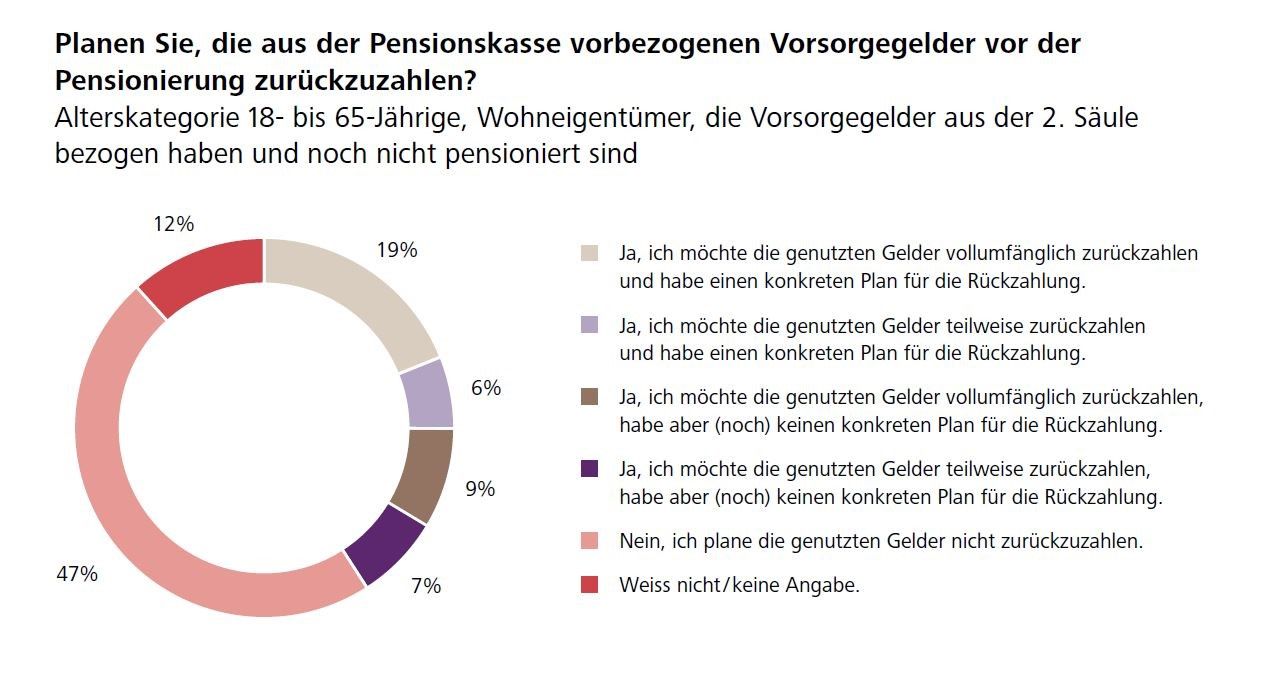

Many people are not concerned about repaying the funds they have withdrawn early. Of the homeowners who used funds from the second pillar to purchase their own home, only 25 percent have concrete plans to repay all or part of this capital to the pension fund at a later date. Almost half (47%) do not intend to close the gap in their pension fund.

Tashi Gumbatshang, Head of the Asset and Pension Advisory Competence Center at Raiffeisen Switzerland, comments: “Whenever you buy real estate with an advance withdrawal from your pension fund, you should already plan to close the resulting pension gap. Otherwise, you risk lower retirement benefits, which could jeopardize your standard of living after retirement or your ability to afford your home.” This contrasts with the desire of the majority of respondents to remain in their own homes for as long as possible: 69 percent of 51- to 65-year-olds want to continue living in their familiar surroundings after retirement.

Pension gaps cause anxiety

For 28 percent of respondents who would like to own their own home, taking early withdrawal from their pension fund to finance it is out of the question because they fear losses in their retirement provision. Around half of the homeowners surveyed were able to finance their home without early withdrawal from their second or third pension pillar. Of these, 56 percent decided against withdrawing pension funds because they had sufficient other financial resources available. 28 percent of homeowners did not touch their pension funds because they feared losses in their retirement provisions. “Despite the obvious advantages, many respondents are also aware of the hidden risks associated with financing home ownership through pension savings,” comments Dr. Jürg Portmann, co-head of the Institute for Risk and Insurance at the ZHAW School of Management and Law.

About the survey

For the survey conducted by Raiffeisen Switzerland and the ZHAW School of Management and Law, 1,151 people from the Swiss population aged between 18 and 79 were surveyed between April 11 and April 24, 2024, using a stratified random sample with a link panel. The sample is considered highly representative due to the quality of the panel, although, as with all online surveys, there is a bias toward higher levels of education and greater online activity. Higher levels of education in particular are likely to lead to higher values for income and wealth questions. The survey is considered highly objective, as the data was collected using a standardized questionnaire and statistically evaluated. The survey only shows significant differences (95% confidence level). The cross-sectional survey methodology is well suited to gaining an insight into the knowledge, attitudes, and perceptions of the Swiss population. However, it is not possible to draw causal conclusions. The clusters identified in the study were calculated using hierarchical cluster analysis with the Ward clustering method. For the analysis, response options were aggregated and individual observations were excluded.