Global uncertainty drives prices up.

17.07.2025In uncertain times, different asset classes react very differently. Rising tariffs and the associated risk of inflation and recession usually have a negative impact on stock market prices, while gold investments can gain ground. “Investments in concrete”, i.e. real estate, also appear to be benefiting from rising prices, even if rental income often only generates low margins. At least, that is what the latest figures on real estate price trends from IAZI AG show. Geopolitical uncertainty is boosting demand on the Swiss real estate market, the company writes in its press release.

Watch the related market commentary by Donato Scognamiglio, Chairman of the Board of Directors of IAZI AG, on YouTube.

Uncertainties have a positive effect on all real estate investments

Whether residential property or investment properties, increased geopolitical and economic uncertainty is affecting all real estate submarkets in the form of rising demand and is likely to further fuel price growth in the coming months, writes IAZI. “Due to its stable conditions, Switzerland is once again acting as a safe haven for investors, which is why they are increasingly holding Swiss francs, driving up its value against other currencies such as the euro and the dollar. To ensure continued price stability, the Swiss National Bank has now lowered its key interest rates to zero percent.

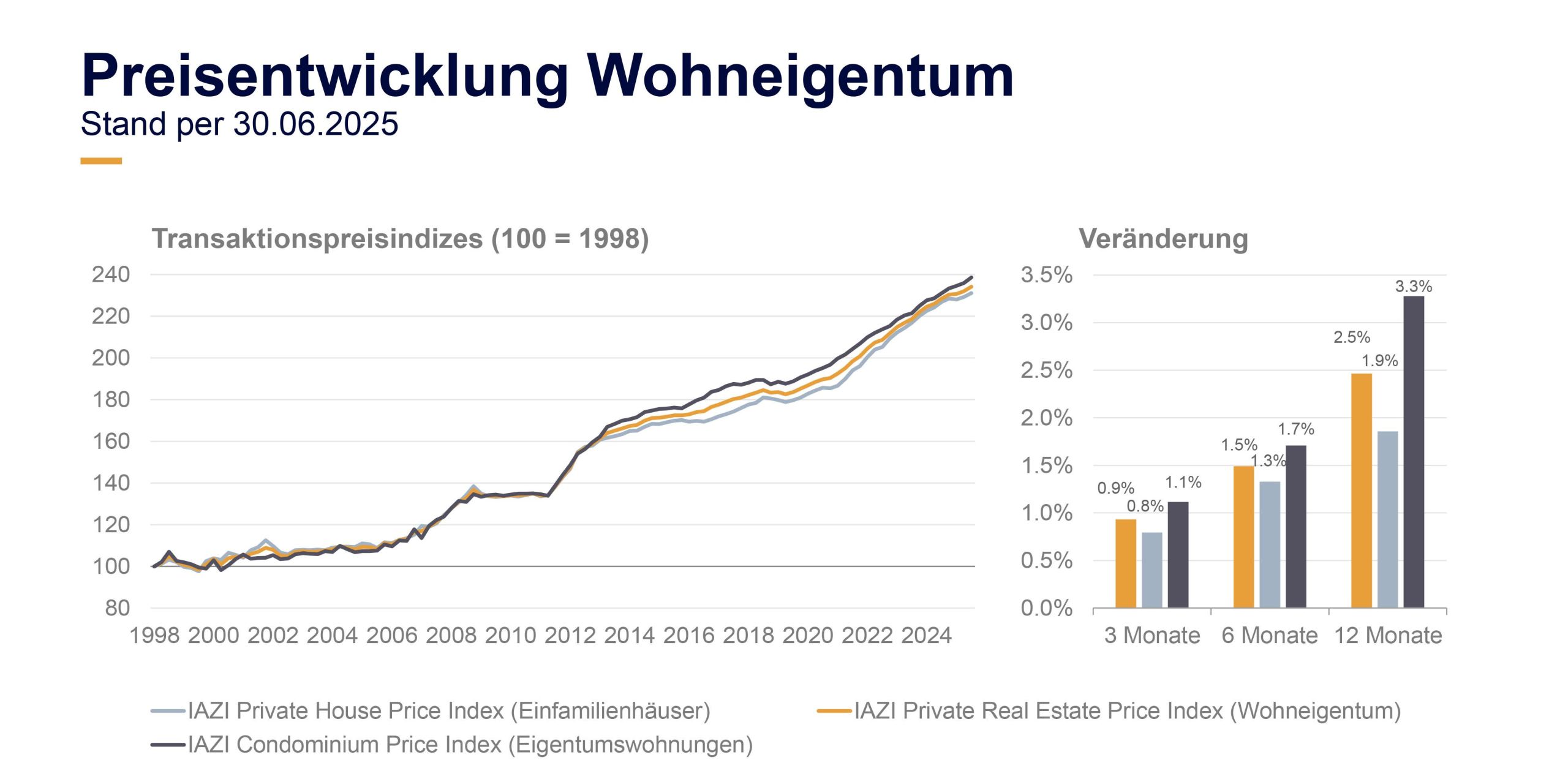

Transaction prices rose by an average of 0.9 percent in Q2

The willingness to pay for residential property rose again in the second quarter of 2025, writes IAZI. Transaction prices increased by 0.9% on average across Switzerland, as shown by the “IAZI Private Real Estate Price Index”.

It continues: “Looking at individual property types, the increase in value of condominiums (+1.1%) slightly exceeded that of single-family homes (+0.8%). Year-on-year, residential property prices rose by 2.5%, returning to close to the long-term average of around 3% per year (since 1998).”

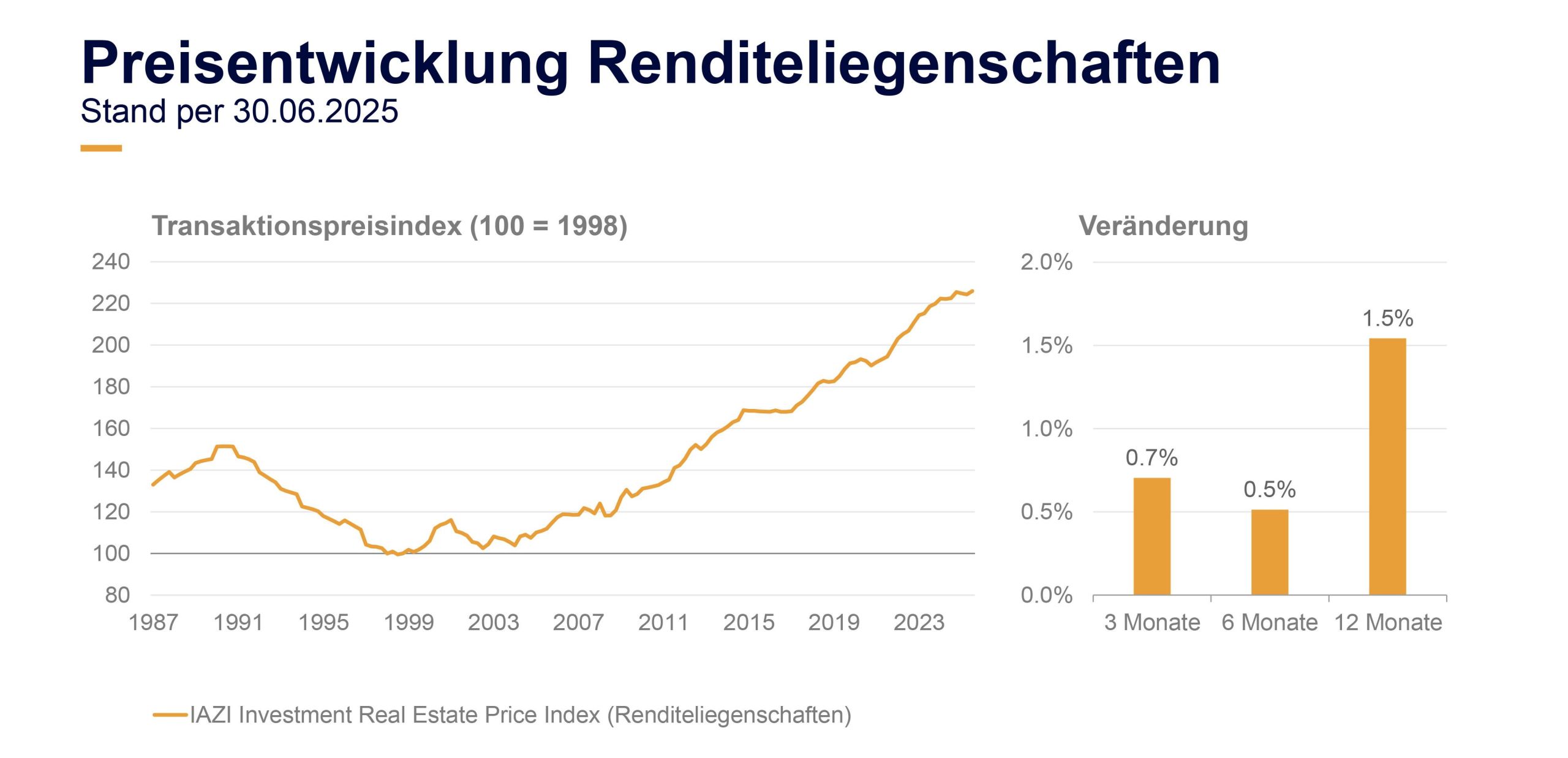

Higher prices also for multi-family houses

According to the “IAZI Investment Real Estate Price Index”, higher prices were also paid for multi-family houses in the second quarter of 2025 (+0.7%). This index measures the price development of residential and mixed-use properties acquired for investment purposes.

After slight price corrections for such investment properties in the two previous quarters, the market mood appears to have turned again with the current growth, according to IAZI. On an annual basis, however, the dip in the growth curve is still noticeable, leading to a comparatively moderate price increase of +1.5% over the last twelve months.

Low key interest rates are driving demand for real estate

With every easing of interest rates, the relative attractiveness of real estate increases from an investor’s perspective, as its returns – unlike those of other asset classes – remain stable in the long term based on rental income, writes IAZI. “For example, yields on 10-year government bonds with a comparable risk profile have fallen significantly in recent months. At the same time, financing conditions are becoming more favorable due to lower interest rates, which is also boosting demand.”

According to the IAZI press release, Switzerland’s robust economic position and positive employment dynamics among companies continue to exert a strong pull on international labor markets, which led to another high net inflow in the first half of 2025. This not only means continued strong demand for rental and owner-occupied housing, but should also indirectly translate into positive momentum for office and commercial space.

Based on these developments, IAZI AG concludes that increased uncertainty, low interest rates, high immigration, and sluggish construction activity will continue to shape the Swiss real estate market for the foreseeable future. The risk of price exaggerations could increase, and market intervention by politicians and regulatory authorities would become more likely.