Individual taxation for homeowners: What it means.

20.01.2026The impact of individual taxation on home ownership can influence how households assess their tax burden and financial planning relating to their own home.

On 8 March, Swiss voters will decide whether married couples should be taxed individually at federal level in the same way as cohabiting couples. If the vote is YES, the cantons and municipalities could also follow this model in future.

The assets of married homeowners would then no longer be taxed jointly, but according to the respective ownership structure. Depending on the family and income situation, this change could increase or decrease federal taxes by several thousand Swiss francs per year.

Wüst und Wüst explains why it makes sense to clarify the ownership structure at an early stage.

Possible effects on affordability and financing planning

In the case of individual taxation, the land registry entry is decisive. If only one spouse is registered, that spouse must pay tax on the owner-occupied property; otherwise, both spouses must pay tax on the property on a pro rata basis. Other assets are also attributed to the person who owns them in the event of a system change.

What owners should pay attention to now

The effects of the system change vary depending on the family situation and income of the spouses. Couples with similar incomes benefit because their incomes are no longer added together and tax progression is less significant. Families with only one income are more heavily burdened, as the non-working spouse can no longer claim child deductions.

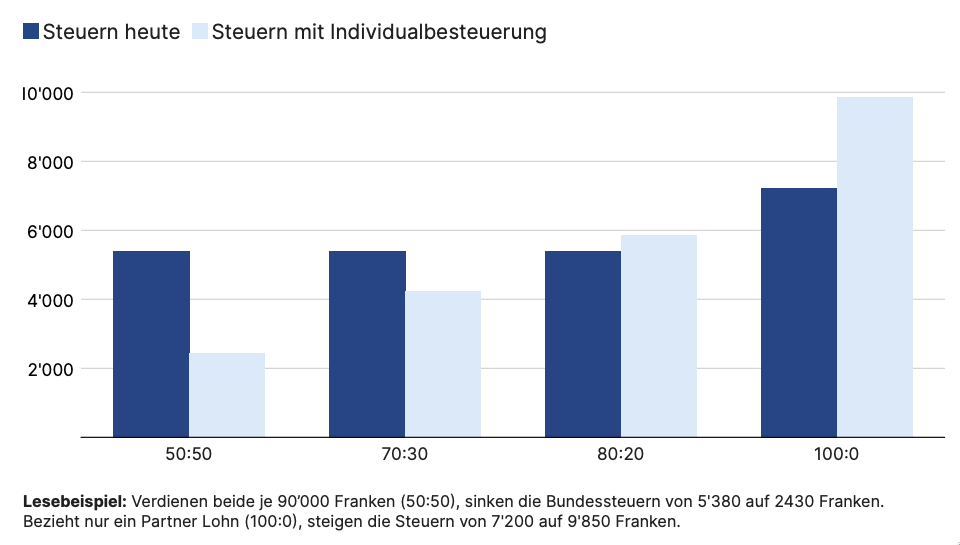

The example of a married couple with one child and an income of CHF 180,000, considering all previous deductions for double earners, clearly shows the significant impact on the amount of federal tax, as illustrated in the chart from VZ VermögensZentrum.

The introduction of individual taxation will only take place in a few years’ time, following a YES vote by the Swiss electorate. Nevertheless, it is advisable to take the necessary precautions at an early stage with regard to ownership of real estate and other assets within the marriage, as depending on the family and income situation, the difference in federal taxes alone can amount to several thousand Swiss francs per year.

When purchasing a property, the advisors at Wüst und Wüst will point out the effects of the system change and the ownership structure entered in the land register. You should also talk to your bank.

Wüst und Wüst is here for you with offices in Küsnacht/Zurich, Zug, Lucerne, St. Moritz and Pfäffikon/SZ, and has an in-house notarial services team. Thanks to this internal expertise, we can comprehensively support both sellers and buyers and address all notarial and legal questions early in the sales process. Our two notarial specialists bring many years of experience in notarial practice and provide real added value for our clients.