Are we now facing a “silver tsunami”?

01.09.2025The baby boomer generation tends to have a high proportion of owner-occupied property. Now that their children have moved out, many older owners live alone in their often oversized houses or flats. Demographic ageing is one of the greatest challenges facing developed economies in the current century. This megatrend is also leaving its mark on the Swiss property market, writes Raiffeisen Schweiz. The bank has taken this development as an opportunity to clarify in its study “Immobilien Schweiz – 3Q 2025” whether a “silver tsunami” is now looming – in other words, whether the real estate market is facing a wave of sales of residential property by baby boomers willing to sell.

In summary, Raiffeisen comes to the following conclusion: “Baby boomers mostly remain in their own homes after retirement, which is why a wave of sales is not to be expected. The willingness of retired homeowners to move remains very low into old age. Despite demographic ageing, prices for residential property are not expected to fall in the future due to scarcity effects.”

No “silver tsunami” expected

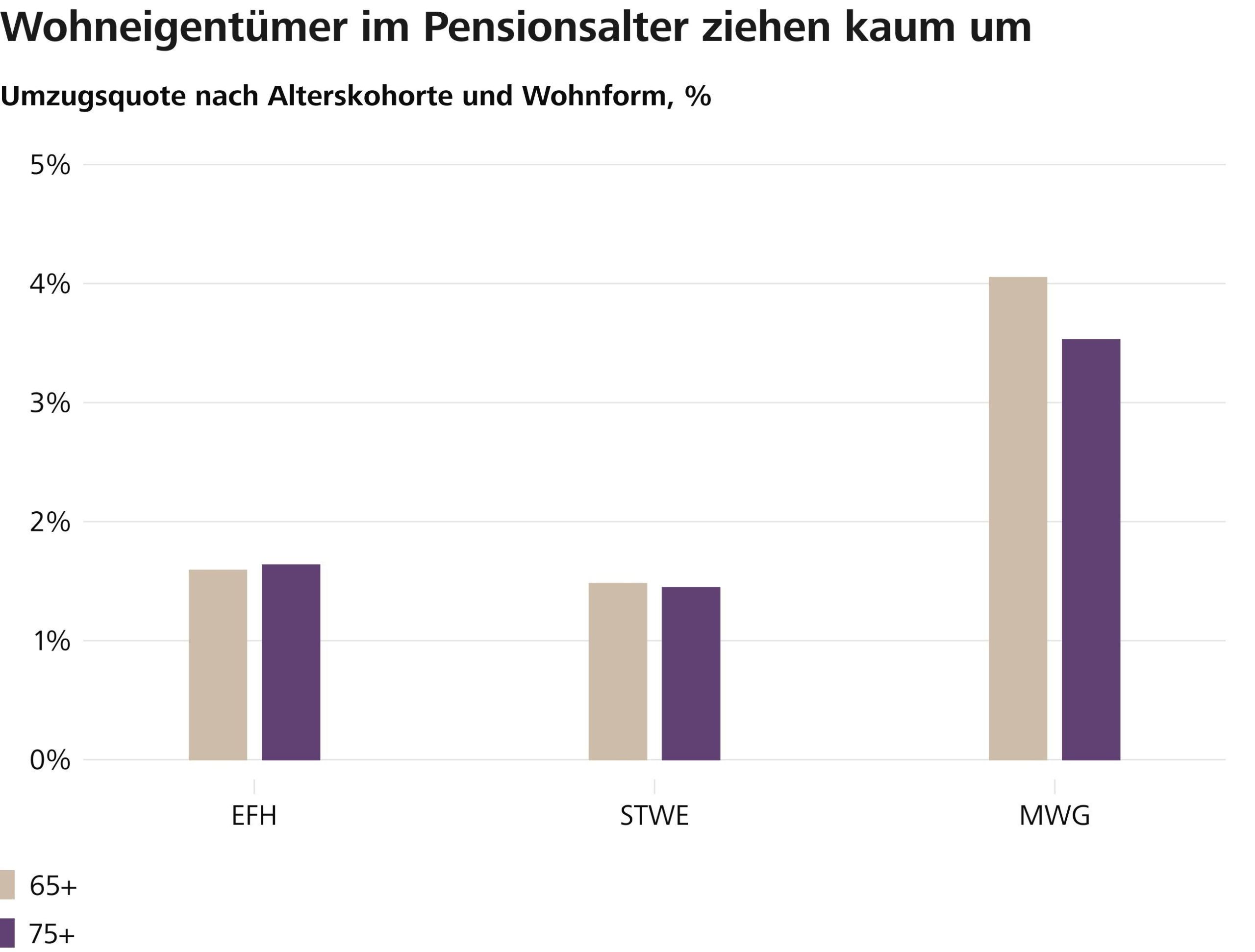

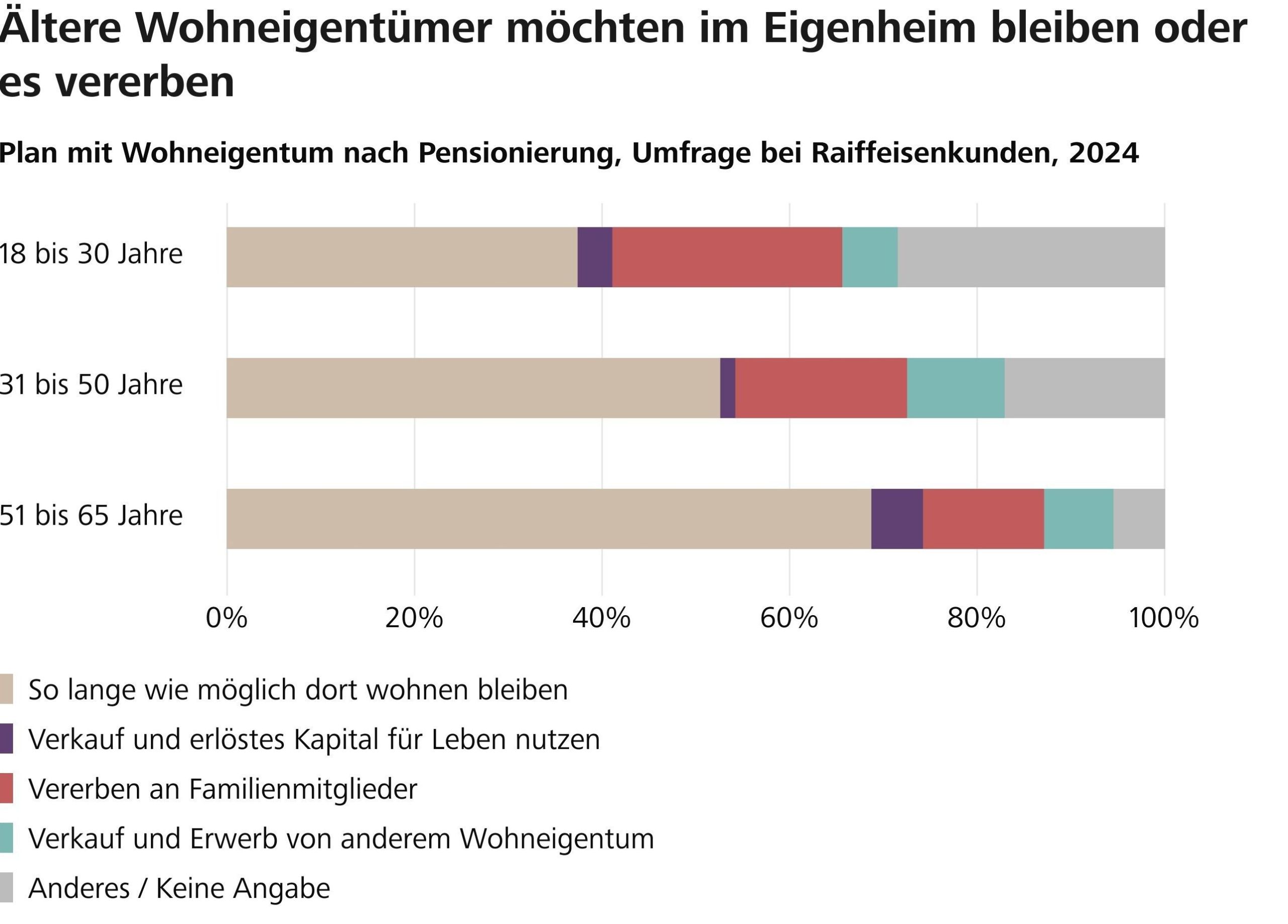

However, according to real estate market experts at Raiffeisen Switzerland, a “silver tsunami”, i.e. a large wave of home sales due to a growing number of baby boomers willing to sell and fewer buyers from younger generations, is not to be expected. Rather, the vast majority of homeowners are very satisfied with their living situation and remain in their own homes for a long time after retirement.

“The decline in home ownership among today’s oldest age cohorts falsely suggests a high propensity to sell residential property in old age. The home ownership rate is only falling in a cross-sectional comparison because, for structural reasons, the cohorts born before 1945 have always had a lower ownership rate than the baby boomer cohorts,” explains Fredy Hasenmaile, Chief Economist at Raiffeisen Switzerland.

Demographic development hardly noticeable due to scarcity

According to Raiffeisen, however, the property market is not completely unaffected by the ongoing demographic ageing process. This has an impact on demand for property and is reflected in weaker price dynamics. Raiffeisen writes: “For example, demographically young communities with a 15 per cent share of over-65s have recorded annual price growth of around 0.75 percentage points higher than communities with twice the proportion of over-65s over the past three years. Nevertheless, factors such as the severe shortage of supply, low interest rates and high immigration have had a much greater impact on price developments than the ageing of our society, and this is unlikely to change fundamentally in the future.”

On the one hand, the wage gap with other countries means that Switzerland can continue to expect robust immigration, according to the Raiffeisen study. On the other hand, the increasing number of older households is leading to more inefficient use of living space, which will cause the shortage on the Swiss property market to persist in the long term.

“Anyone hoping for a fall in property prices in the near future due to demographic developments is likely to be disappointed. Falling property prices or even price slumps due to demographic developments are not to be expected in this country in the future. Rather, demographic change can be seen more as an opportunity to alleviate the housing shortage to a certain extent than as a threat to the price structure,” concludes Hasenmaile.

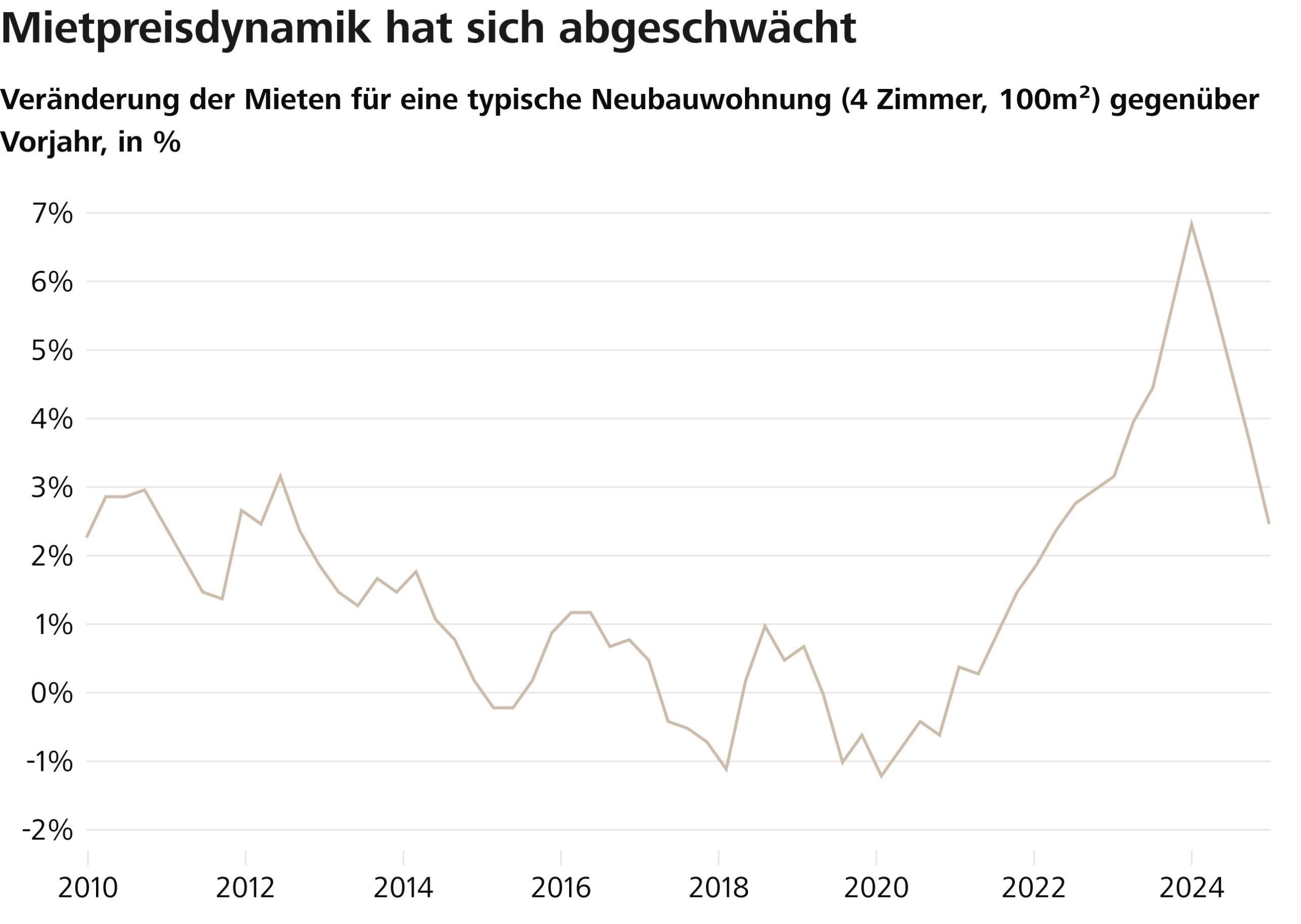

Supply on the rental housing market remains scarce

Raiffeisen writes that a glance at the rental housing market also shows how severe the housing shortage has become. It continues: “Due to weaker immigration and a slight increase in supply, the upward pressure on rental prices has eased somewhat recently. However, the situation remains very tense overall.” The lively public debate about the lack of housing supply has not yet led to a significant acceleration in housing construction, which is why demand continues to significantly exceed supply.

“Accordingly, a noticeable increase in asking rents and a decline in vacancies must also be expected in the Swiss rental housing market in the future,” Hasenmaile states.