Zero interest rates: good or bad for you?

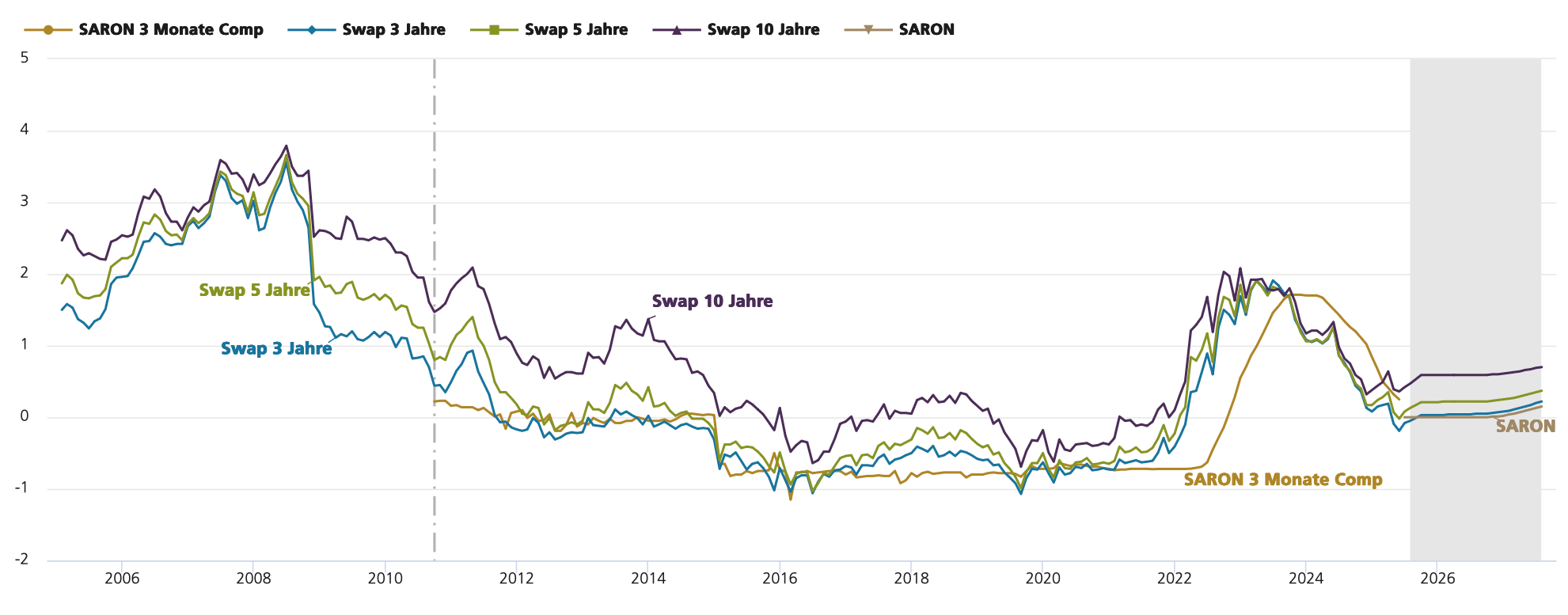

23.06.2025In its latest interest rate forecast, UBS believes that the SNB’s cycle of interest rate cuts is now likely to be over following the recent reduction to zero percent. UBS cites easing inflationary pressure as the reason for this move. If the economic outlook does not deteriorate further in the coming months, UBS believes that the SNB is likely to have concluded its cycle of interest rate cuts.

It writes: “Fears that the USA’s protectionist trade policy could trigger a significant economic slowdown led to a marked fall in yields on Swiss government bonds and mortgage interest rates until the beginning of May. Since then, however, Swiss interest rates have moved sideways.” Only if the US government tightens its policy further, thereby placing additional strain on the economy, would negative SNB interest rates be conceivable; however, the likelihood of such a scenario has decreased with the recent easing of the tariff dispute, is the forecast from UBS.

What does this mean for Swiss government bond yields and mortgage rates? As the market had already anticipated another interest rate cut, no noticeable changes in longer-term interest rates are expected. According to UBS, Swiss government bond yields and mortgage rates are likely to remain within their current range. Even for SARON-linked mortgages, the bank does not expect interest rates to fall.

However, Raiffeisen Switzerland comes to a slightly different conclusion in its commentary on the current mortgage market. It expects that with the SNB’s interest rate cut to zero percent, “SARON mortgages will once again become cheaper than most fixed-rate mortgages. As slightly negative interest rates have been anticipated on the interest rate markets for some time now, financing conditions for longer-term fixed-rate mortgages were already at lower levels before the interest rate decision. This means that even with a slightly negative key interest rate, there should not be much downside potential in the long run. And if the SNB ends its easing cycle at the current level, fixed-rate mortgages could even become slightly more expensive again later in the year.

The consequences for the real estate market

Regarding the real estate market, Raiffeisenbank also expects lower interest rates to make financing conditions for home ownership much more attractive again. It believes that zero interest rates will further boost buyer confidence and stimulate demand for residential real estate. However, the trend toward cheaper money is likely to be offset by rising prices. Due to scarce supply and rising demand, prices are likely to rise again.

The consequences for tenants, savers, and travelers

Following the SNB’s decision, SRF’s business editorial team assessed the possible consequences of zero interest rates for homeowners, tenants, savers, and travelers.

It forecasts the following developments:

“Homeowners: Contrary to expectations, interest rates on short-term mortgages are rising slightly – the market had expected a stronger interest rate hike. The picture is similar for long-term mortgages. In contrast, money market mortgages based on SARON are becoming cheaper again.

Tenants: The decision puts pressure on the mortgage reference rate, but has no immediate impact. Rents may only fall after a delay. The reference rate is currently 1.5 percent.

Travelers: The move was smaller than many market participants had expected – in an initial reaction, the Swiss franc gained in value. This is good news for Swiss travelers, but it dampens export prospects. However, it remains to be seen how the value of the Swiss franc will develop.

Savers: Those who park their money in savings accounts cannot rejoice at zero interest rates. However, as inflation is low, and currently even slightly negative, at least their money is not losing value.