How the state benefits from the property boom.

17.11.2025The current edition of the Raiffeisen study “Immobilien Schweiz – 4Q 2025” devotes its main chapter to the question of how the public sector in Switzerland benefits from the property boom. The foreword to the study states: “If the public sector needs additional revenue and therefore increases taxes, there is always a risk that taxpayers or companies will respond by moving away to avoid the higher burden. This problem does not arise with real estate. It is inextricably linked to its location and cannot be avoided. From a tax perspective, real estate is therefore a particularly rewarding and reliable source of income.”

Real estate is subject to a variety of different taxes and levies

The study concludes that even after the abolition of the imputed rental value, the public sector will continue to collect substantial tax revenues from owners of domestic properties — in particular through property gains tax. This is unique in that private individuals are only subject to capital gains tax on real estate investments. As a rule, only capital gains are taxed in Switzerland, as assets are already subject to wealth tax.

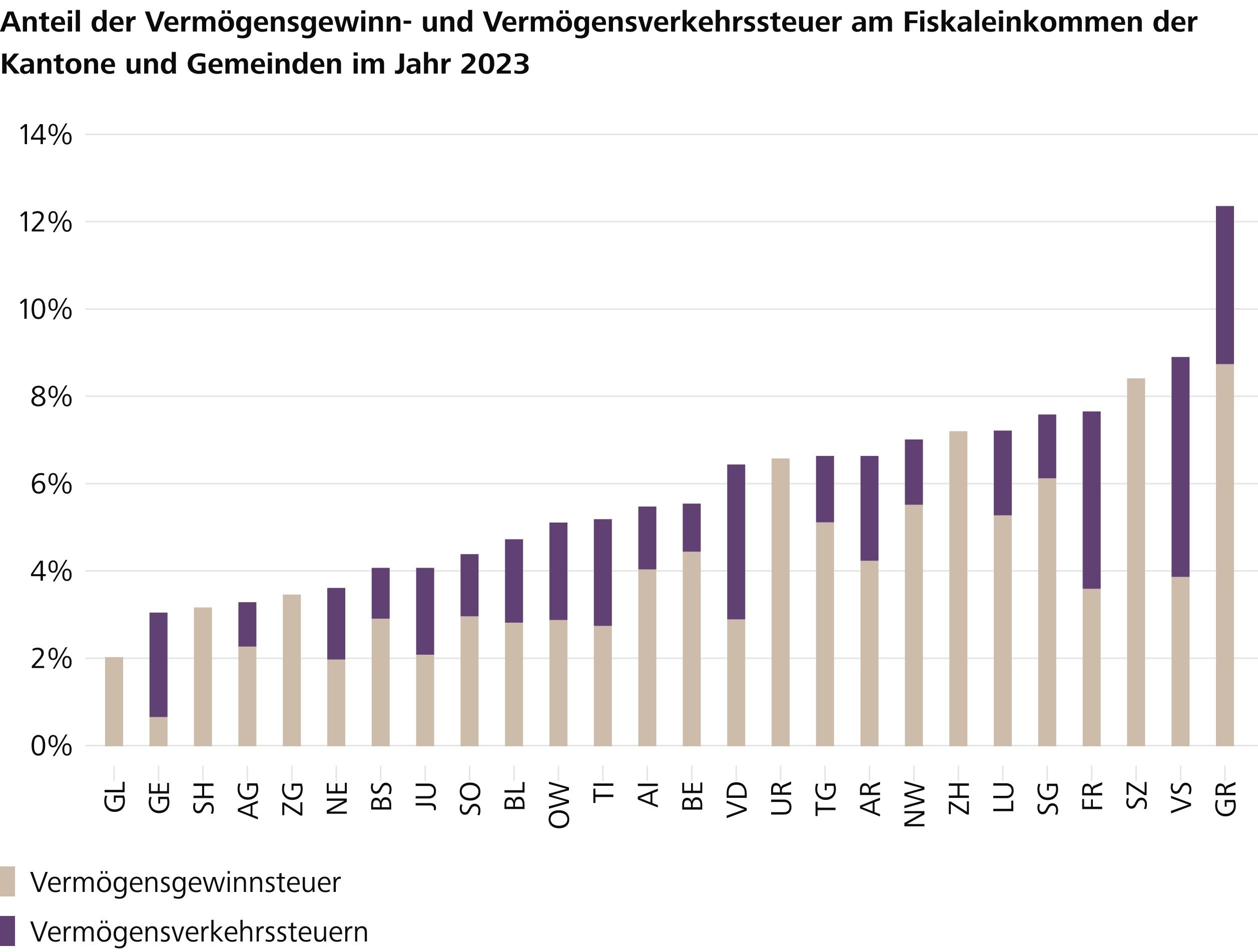

Two points particularly caught the attention of the authors of the study: “Firstly, the strong growth in property tax revenues. Through property gains tax and transfer duties, cantons and municipalities participate directly in the increase in value of real estate owners’ assets. Given the sharp rise in property prices over the past two decades, tax revenues have also skyrocketed. Today, they make a significant contribution to financing the national budget.” Secondly, it is striking how different the taxation of capital gains from property sales prescribed by federal law for the cantons is. As mentioned above, since property cannot be moved, tax competition hardly sets any limits on this diversity for once.

Major cantonal differences in the taxation of property transfers

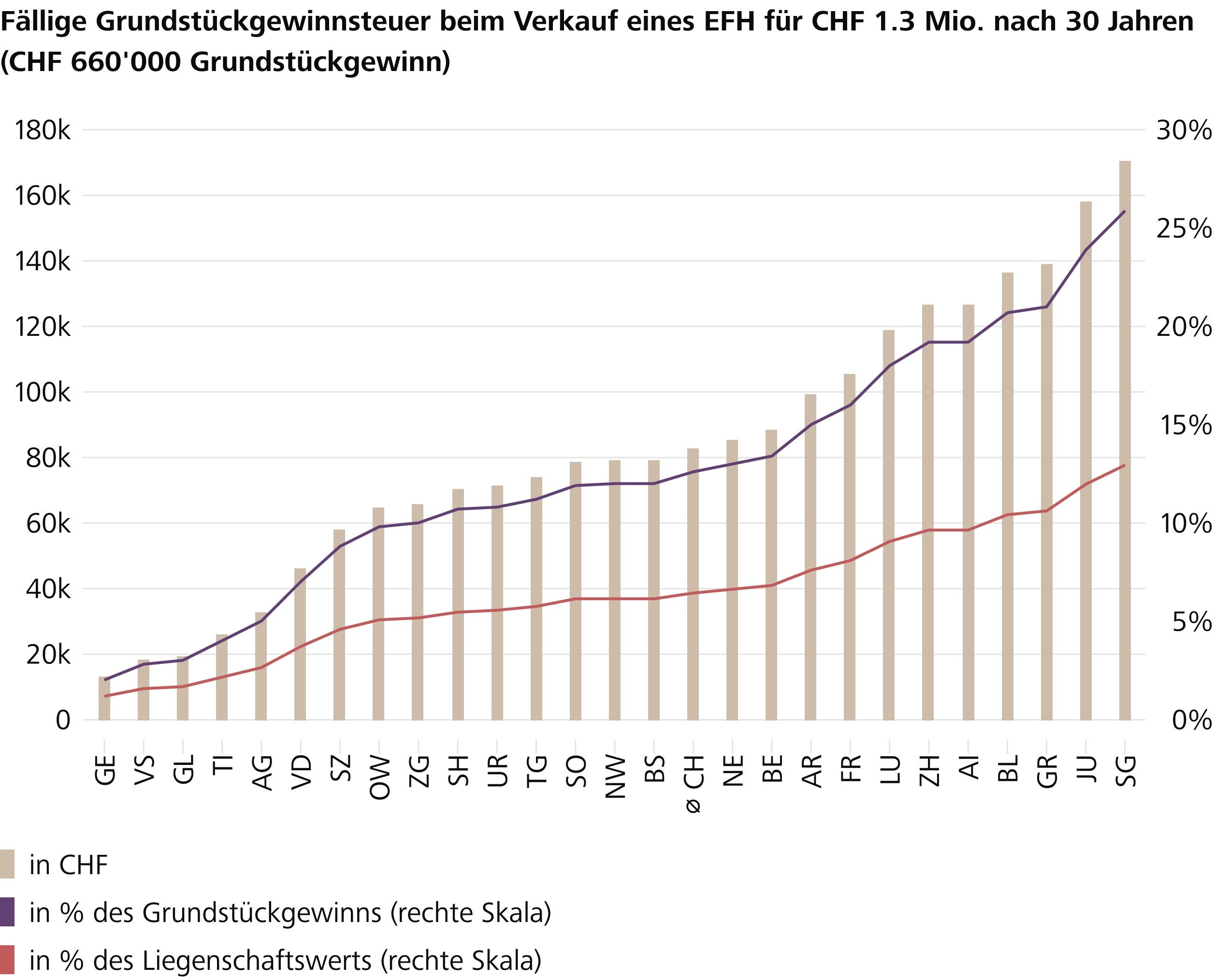

Although state revenue from real estate transactions has become an indispensable part of the state budget in most cantons, cantonal taxation of real estate sales varies greatly, writes Raiffeisen Switzerland in its press release. It continues: “Not all cantons levy a transfer tax, for example. There are also significant differences in the calculation of the capital gains tax due in each case. For a typical single-family home, a 30-year holding period and a capital gain of CHF 660,000, the average cantonal tax rate on this gain is 12.6 per cent (CHF 83,000). However, the range for this example property extends from just 2 per cent (CHF 13,000) in the canton of Geneva to 26 per cent (CHF 170,000) in the canton of St. Gallen.

“Although the same principles apply to the taxation of property gains throughout Switzerland, the cantons are clearly making use of their considerable leeway in the specific design of their tax systems. The wide variety of methods used to calculate the profits generated, the tax rates and the prescribed holding period discounts lead to very heterogeneous tax treatment of property sellers depending on the location of the property sold,” states Fredy Hasenmaile.

Other important economic topics covered in the study

The study also addresses other important economic issues relating to the property market. It analyses the economic framework conditions, the lack of construction momentum despite a favourable market environment, the expected price increases in the owner-occupied housing market, the challenges in the office space market and the record high capital inflows into property investments. Downloading the study as a PDF is therefore worthwhile for anyone interested in the property market.